TVM 2$days

TVM Tuesdays is a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.

Sign up for email notifications:

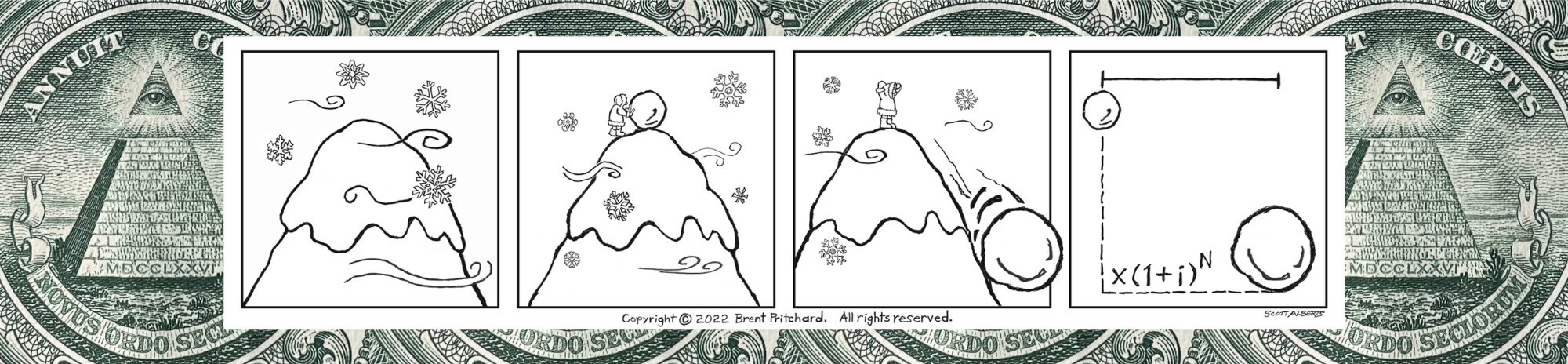

Time Grows Hair and Millionaires.

Time and time again, I have received what I think of as a milestone haircut from my barber, Mark Rathke (owner-barber of Mark’s Styles & More in Coralville, IA.) I first met Mark when I was a college student looking for a high and tight haircut. He was cutting hair in a barbershop that was owned by two other guys. Since that time, he has given me my:

“College Graduation Haircut”

“You’re Starting Your Career as a Finance Professional Haircut”

“You’re Getting Married This Weekend Haircut”

“MBA Haircut”

“You’re Going to be a Dad Haircut”

“You’re Going to be a Dad Again Haircut”

“It’s Another Girl Haircut” (The list goes on and on.)

Photo by Brent Pritchard.

After my most recent haircut, which was deserving of a tip and maybe even the name of this post, we were talking about my book. He was sharing his thoughts with me about how it can help even the non-finance person gain more financial literacy. “Walk into any investment advisor’s office,” I said “and ask them what they think is the number one topic related to finance and money. There’s no question about this question,” I said. “It’s the Time Value of Money!”

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

Time is something you want on your side. That’s one of the best ways I’ve come to summarize the Time Value of Money. In the Preface, I said that I have a few regrets. One of those is not executing on this idea I had when our daughters were born, which was to save $1,000 on each date of birth and each annual celebration thereafter through and including their 18th birthdays. Assuming a true annual investment yield of 10%, each of these annual investments would have been expected to grow to $1,739,611 by the time each of our daughters turns fifty-five and $4,512,103 at the age of sixty-five. (I guess I have some books to sell…)

Like these numbers? Then keep on reading! Don’t worry if you don’t know how to calculate Future Value at this point. This book, in particular Part 2, will help you with that. These numbers obviously don’t consider ups and downs in the markets; here our focus is simply on the Mathematics of Finance. Did you pick up on the fact that we’re only talking about nineteen annual deposits of $1,000! In the absence of this investment strategy and assuming the same true annual investment yield of 10%, if one were to invest $1,000 annually starting on their twenty-third birthday and continuing through and including their fifty-fifth birthday, they would expect to have an investment with a balance of $222,252. Adding ten more years of annual deposits of $1,000 the savings would be expected to grow to $592,401 by their sixty-fifth birthday. That’s a far cry from $1,739,611 and $4,512,103, respectively. It is estimated to take thirty-three annual deposits of $7,827.22 from one’s twenty-third birthday to fifty-fifth birthday or forty-three annual deposits of $7,616.64 from one’s twenty-third birthday to sixty-fifth birthday to expect to accumulate $1,739,611 or $4,512,103, respectively. Again, this is assuming a true annual investment yield of 10%. Move over birthday gifts that collect dust and take up room in a corner...show me the birthday money! See what I mean by wanting time on your side?

By delaying consumption and investing in the future, you have the potential to change your family tree and provide a legacy for not only your children but their children’s children and beyond. Let’s go back to the example that contemplates nineteen annual deposits of $1,000. You’ll want to know how much that would be expected to grow to over a total investment period that includes seventy-five years. That number would be $11,703,233. Still not enough? Are you sitting down? After a total investment period that includes eighty-five years, this investment strategy would be expected to have a future value of $30,355,174. Now that’s a nice nest egg!

Anyone who has the ability to earn money needs to realize that there is no question that you can become a millionaire.

The question isn't “Where should I invest my money?” as much as it is “Who in my life would benefit from learning about the simple most important topic related to finance and money, and the potential for an investment portfolio to snowball by simply investing early and often?”

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Rising Finance Professionals Should Know How the Date of Easter is Determined.

Happy Easter! I think I can still say that. (Makes me think about how far into January I’ve wished someone happy new year.)

Photo by Brent Pritchard.

Not every holiday is celebrated on the same date every year. You probably knew that already. Enter Easter. This year Easter was celebrated on March 31. It’s not like Christmas, which always falls on December 25.

But would you believe me if I told you that there’s something all aspiring and current finance professionals can learn from Easter? Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

Sometimes we can overcomplicate things. Life is really pretty simple when you stop and think about it. I remember another one of Clayton John’s lessons like it was yesterday. In classic Clayton John fashion, one day he asked a group of us a rhetorical question: “How is the date of Easter determined?” What he taught us that day was that you have to care enough to know how things work and not be afraid of the hard work it might take to figure it out. There’s no “kind of” or “maybe.” It’s yes or no. You get it or you don’t.

Because of this lesson, I can think of a handful of people who still to this day could tell you how the date of Easter is determined. You don’t forget a lesson like that. For those who want to know it’s the first Sunday, after the first full Moon, on or after the Vernal (Spring) Equinox. Kind of rolls off the tongue, doesn’t it?

Since I gave you the answer, do me a favor and don’t lose the important lesson here. The lesson is one of caring enough to do the work.

Before Clayton John made the trek to Cedar Rapids, Iowa, financial calculator in hand, responding to the job posting he saw in the Wall Street Journal and would later get, he was a high school math teacher in Albert City, Iowa.

I love this story for a lot of reasons. First and foremost, it showcases an important sequence that many people outright ignore. First comes the math, then comes the finance.

How many building block Time Value of Money equations are there? (I can guarantee that Clayton John knows.)

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Finance Students Must Read This.

If you’re like many of the students I interact with, you might struggle applying the Time Value of Money. It’s okay. It’s not your fault. Rarely do we find ourselves (in the boat) all alone. You might choose to blame it on traditional publishers. (That’s what I do. But I also own the solution.) That’s why I wrote Would Your Boomerang Return? It’s the book I wish I would have been able to read when I was in your (boat) shoes.

This image was created with the assistance of DALL·E and prompts from Brent Pritchard.

Have you ever gotten seasick? It’s horrible. If your experience was anything like mine, it might be your best unintended ab workout ever. Okay, so we can agree that throwing up over the side of a boat is no fun.

Know what else should make you want to vomit? The thought of trying to learn most of what there is to know about the most important concept in the field of finance in one chapter of a traditional textbook. Many of the concepts that you’d benefit from learning about find their way to the traditional publisher’s cutting room floor, which is why one chapter isn’t cutting it.

This seems to be a problem many aspiring finance professionals don’t know they have. That or they’re in denial. Part of the problem might stem from TVM being so Finance 101. But the Mathematics of Finance isn’t a one-and-done thing. It’s definitely not binary: more a spectrum of comprehension.

Would Your Boomerang Return? is packed full of all the important information on this all-important topic in one place. Wrapped within the cover of the book is a present you’ll value: the confidence that comes with being able to analyze and evaluate real-world Time Value of Money situations in a repeatable manner. It’s a fun, easy read. “An ‘anti-textbook’ is the antidote.” It’s unlike any finance textbook you’ve ever read, which is why you must read this book.

Photo by Brent Pritchard.

One of my favorite things about being an author is when a reader takes time out of their day to tell me how my book has positively impacted them. Not that long ago, a student, with a smile of his face, asked me whether I’d started fly fishing. He wanted to hold me accountable for something I wrote about in the chapter that uses the fly fishing concept of “matching the hatch” to remind you that you first might need to manipulate the discount rate before you can estimate present value. You’re not going to find that in a traditional textbook. Although, you might dream such a little dream of me fly fishing after being put to sleep reading a traditional textbook as an unintended bedtime story.

We know that time is our most precious resource. As an aspiring finance professional, you owe it to yourself to understand the Time Value of Money like the back of your hand. You make time for things you care about. What about your future?

What can you do during the next week to add value and move one step closer to manifesting your dreams?

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Get the Book Today!

Would Your Boomerang Return? provides a fun, new take on how the Mathematics of Finance is learned and taught:

All-in-one resource: all the important information on this all-important topic in one place with chapters in the What and How sections that double as individual lessons

Ease of reference: includes the first-of-its-kind user manual for the Mathematics of Finance with chapters named after sections typically found in an actual user manual for quick look up

Simple and definitive tool: 3-Step Systematic Approach for analyzing and evaluating real-world Time Value of Money situations

Decision-making framework: 23 real-world Time Value of Money questions, space to work out answers, and a "baseball count" system to evaluate understanding of the different types of questions

An easy read: complete with sprinklings of real-life stories and maybe even an ounce of inspiration here and there

Sign up for TVM 2$days, a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.