Finance Students Must Read This.

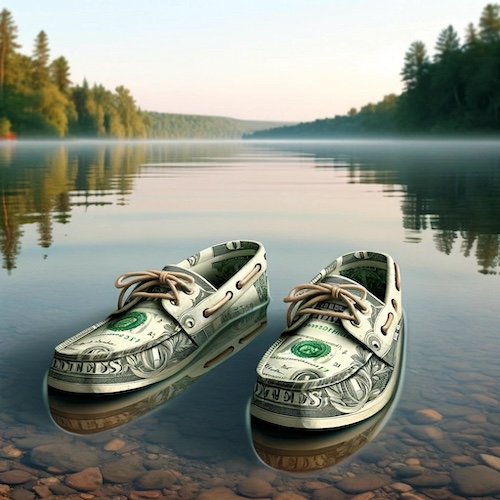

If you’re like many of the students I interact with, you might struggle applying the Time Value of Money. It’s okay. It’s not your fault. Rarely do we find ourselves (in the boat) all alone. You might choose to blame it on traditional publishers. (That’s what I do. But I also own the solution.) That’s why I wrote Would Your Boomerang Return? It’s the book I wish I would have been able to read when I was in your (boat) shoes.

This image was created with the assistance of DALL·E and prompts from Brent Pritchard.

Have you ever gotten seasick? It’s horrible. If your experience was anything like mine, it might be your best unintended ab workout ever. Okay, so we can agree that throwing up over the side of a boat is no fun.

Know what else should make you want to vomit? The thought of trying to learn most of what there is to know about the most important concept in the field of finance in one chapter of a traditional textbook. Many of the concepts that you’d benefit from learning about find their way to the traditional publisher’s cutting room floor, which is why one chapter isn’t cutting it.

This seems to be a problem many aspiring finance professionals don’t know they have. That or they’re in denial. Part of the problem might stem from TVM being so Finance 101. But the Mathematics of Finance isn’t a one-and-done thing. It’s definitely not binary: more a spectrum of comprehension.

Would Your Boomerang Return? is packed full of all the important information on this all-important topic in one place. Wrapped within the cover of the book is a present you’ll value: the confidence that comes with being able to analyze and evaluate real-world Time Value of Money situations in a repeatable manner. It’s a fun, easy read. “An ‘anti-textbook’ is the antidote.” It’s unlike any finance textbook you’ve ever read, which is why you must read this book.

Photo by Brent Pritchard.

One of my favorite things about being an author is when a reader takes time out of their day to tell me how my book has positively impacted them. Not that long ago, a student, with a smile of his face, asked me whether I’d started fly fishing. He wanted to hold me accountable for something I wrote about in the chapter that uses the fly fishing concept of “matching the hatch” to remind you that you first might need to manipulate the discount rate before you can estimate present value. You’re not going to find that in a traditional textbook. Although, you might dream such a little dream of me fly fishing after being put to sleep reading a traditional textbook as an unintended bedtime story.

We know that time is our most precious resource. As an aspiring finance professional, you owe it to yourself to understand the Time Value of Money like the back of your hand. You make time for things you care about. What about your future?

What can you do during the next week to add value and move one step closer to manifesting your dreams?

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.