TVM 2$days

TVM Tuesdays is a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.

Sign up for email notifications:

Soft Skills Are [Bleeping] Hard!

What I now refer to as the “A Game” came about after hearing feedback that [most] students don’t know how to lead small-group meetings. If you’re reading this and your name is Jerry, then to you I’d say, “It’s Gold, Jerry! Gold!”

Memo

To: Residents of Planet Earth

From: Brent Pritchard, (of which I am a) Member

Date: July 31, 2025

Subject: (Effectively Participating in and) “Leading ‘A Meeting’” (aka the “A Game”)

Employers want and need team members who add value. Adding value takes different forms but always involves someone bringing their A game, the performance of which might be demonstrated through leading, delegating, facilitating, encouraging, etc. This concise guide will give you a tool for when it comes to (effectively participating in and) “Leading ‘A Meeting.’” What I mean by “A Meeting” will soon become clear.

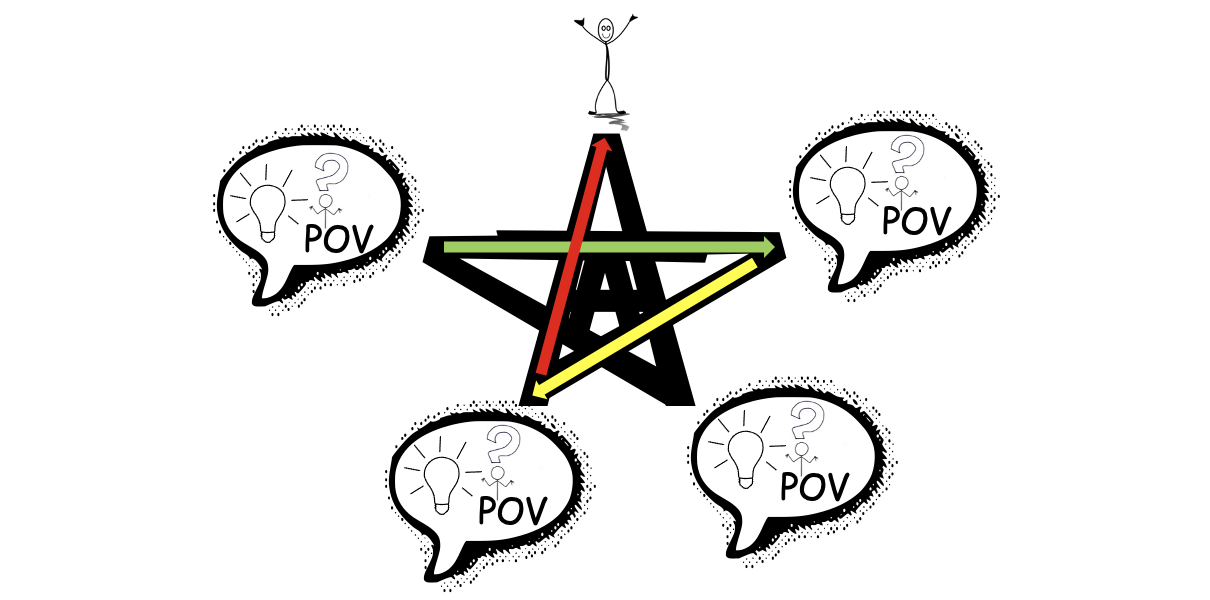

The letter A when capitalized, copied, and arranged in just the right way forms a star. Along with asking of yourself the right 5 W and 1 H questions, this provides the North Star for (effectively participating in and) leading A Meeting.

Imagine the presenter is always (in the north position) at the top of this star. The lines form to make an “A Game” that requires that the presenter(s) must schedule time in the agenda for engaging dialogue (between all present) since participants will be providing Q&A and their unique POV (Point of View). By way of example, if the presenter asks a question related to the topic at hand, then they shouldn’t plan to proceed with their presentation and the scheduled agenda until at least 4 individuals contribute a Q, A, or POV. By way of further example, if a question or POV originates from the audience then it takes 2 or 3 “(your) turns” to give the floor back to the presenter. It might also be helpful to think of the colors of a traffic light: green (beginning), yellow (middle), and red (end). In summary, the direct route is out in favor of a more inclusive conversation.

In class, I call this the A Game. Students will earn (all-or-nothing) points based on this expectation for (whole) class engagement, which provides opportunities to develop and refine such “skills that pay the bills” as collaboration, planning and organization, time management, critical and independent thinking, effective communication, problem-solving, leadership skills, and giving and receiving feedback, among others.

The 5 W and 1 H questions provide a complementary framework for preparing for and engaging with meeting content. At a bare minimum, here is a list of questions that need to be answered by either the presenter(s) or those present at the meeting.

Who (will lead the meeting, on the team can expect to present on a certain topic, are the people that can share information and must receive an agenda beforehand)?

What (should we expect for questions)?

When (does this meeting start and end and would it make the most sense for transitions between timed agenda items for good flow)?

Where (are there opportunities to engage by asking questions, providing answers, and offering my unique point of view)?

Why (is this relevant and a real-world consideration)?

How (will we know that the meeting was a success and desired outcomes achieved)?

1 W is spelled with the same letters as the 1 H…bookends for meeting strategy and preparation. These tactics will help you when it comes to (effectively participating in and) leading A Meeting or earning (whole) class engagement points with the A Game.

The question mark on top of a stick figure (201404-Why) was created by Tsahi Levent-Levi and is subject to a creative commons license: as of the time the (unchanged) image was incorporated into the creative work also known as the “A Game” and described in a memo under the same name (Copyright © 2025 Boxholm Press, LLC. All rights reserved.)

Brent Pritchard is an author and college finance educator with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Introducing the HP-12C(RE)!

Some things can’t wait until Tuesday…. Are you a commercial real estate (CRE) finance professional? If so, you likely know all about the HP-12C financial calculator. (Why would you use anything else?!)

One doesn’t need to be a real estate professional to know about the Four Corners. You know the piece of real estate where the four states of AZ, CO, NM, and UT meet.

Today, I introduce the HP-12C(RE)…that’s the HP-12Commercial Real Estate (style)…to the wide world (all of which is real estate). (And you’re not considering a career in real estate because…?)

If you’re practicing CRE, whether in the field or classroom, here is how you can use the memory of the HP-12C financial calculator, thus turning into an HP-12C(RE):

Photo by Brent Pritchard. Copyright 2025 Brent Pritchard. All rights reserved.

These are the four corners of the HP-12C memory keys that consist of the most important investment or credit metrics. Notice how these memory keys minimize your movements by putting the number you need to divide by close by. (Like a guitarist efficiently gliding their fingers along the fretboard.) Further notice how the “DY” memory key can be used for either the Going-in Debt Yield (GI)DY or the Exit Debt Yield (E)DY.

Hands down, these are the memory keys CRE finance professionals should use when analyzing a deal.

How do you know when to give a real estate deal the green light?

Brent Pritchard is an author and college finance educator with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

No Wonder You Have a Restless Mind.

Recently I got some great unsolicited advice: “If you work with your mind, you need to rest with your hands. If you work with your hands, you need to rest with your mind.” This nugget of wisdom came after I decided to commit 12 Indian dishes to memory before the clock strikes midnight on December 31. I want to eat healthy and be able to put a curry dish on the table in no time. The act of cooking Indian food, in particular, relaxes me. Regardless of what you think about Indian food, who doesn’t like a twofer?

I’m learning how to cook Indian food asynchronously and with the unbeknownst tutelage of Atul Kochhar, a Michelin star chef. Check him out on YouTube. He’s great!

Photo by Brent Pritchard.

Screenwriters talk about the three-act structure, which at its most basic level breaks a story into a beginning, middle, and end. The same structure works with books as well. Thanks to Steven Pressfield and his work (Turning Pro and Nobody Wants to Read Your Sh*t), I kept this structure in mind as I wrote Would Your Boomerang Return? This year, in addition to getting back into a regular writing routine, I also want to learn how to cook Indian food. Would you believe me if I told you that I’ve found a kind of three-act structure to cooking Indian food?

Two of my greatest skills are quickly identifying patterns and simplifying complexity. I’ve come to understand a beginning and middle and end as it relates to cooking Indian food. Just like every good movie follows some version of the three-act structure, so too does every good Indian dish (I think):

Beginning: gently toast dried, whole spice(s) in hot oil followed by green chiles and ginger or garlic and then onion (if you’re looking for a tearjerker).

Middle: main ingredient after which the recipe is named enters the cast iron skillet followed by masala that 9 times out of 10 includes coriander powder, turmeric powder and red chili powder.

End: dish is further differentiated with the supporting ingredient(s) and finished with other powdered spices and such.

The dish I’m learning in February is Khatti Gobi, which I understand translates to sour cauliflower. Even if this pattern to Indian cooking is just a figment of my imagination, it works for me. I know that cauliflower enters the p(l)ot at the start of Act 2, and that lemon juice is probably making an appearance in Act 3 when the p(l)ot thickens.

How are you finding balance and resting with your hands or mind?

Brent Pritchard is an author and college finance educator with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Get the Book Today!

Would Your Boomerang Return? provides a fun, new take on how the Mathematics of Finance is learned and taught:

All-in-one resource: all the important information on this all-important topic in one place with chapters in the What and How sections that double as individual lessons

Ease of reference: includes the first-of-its-kind user manual for the Mathematics of Finance with chapters named after sections typically found in an actual user manual for quick look up

Simple and definitive tool: 3-Step Systematic Approach for analyzing and evaluating real-world Time Value of Money situations

Decision-making framework: 23 real-world Time Value of Money questions, space to work out answers, and a "baseball count" system to evaluate understanding of the different types of questions

An easy read: complete with sprinklings of real-life stories and maybe even an ounce of inspiration here and there

Sign up for TVM 2$days, a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.