TVM 2$days

TVM Tuesdays is a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.

Sign up for email notifications:

Finance Professionals’ Pride and Joy is TVM.

I hope I’m not giving too much away, but in my classroom, I follow a simple model: it’s impossible for people to laugh without smiling, and when people are smiling, they’re happy. One of the things I do to get people energized (and later engaged) is playing that old time rock and roll. One of my favorites. The late, great Stevie Ray Vaughan (SRV).

(In real life, we have Marty McFly to thank for inspiring John Mayer—my second favorite guitarist behind SRV—to pick up the guitar. Well done, McFly!)

This image was created with the assistance of DALL·E and prompts from Brent Pritchard.

Supposedly, the great Texan and guitarslinger had a limited knowledge of musical theory, couldn’t read music, and never played a song the same way twice. While that’s an incredible gift if you’re a musician and virtuoso, aspiring and current finance professionals need to have a sound grasp of the concept of the Time Value of Money, should be able to read the numbers, and ultimately find confidence through repetition.

The hallmark of the TVM Formula, which is described in Would Your Boomerang Return? and that is the 3-Step Systematic Approach, provides just that, so you can get about sharing your unique skills and experiences with the world in your current or future capacity as a finance professional.

Here's a question from the “Pop (Open the Back Cover) Quiz” in Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

You plan to deposit $2,000 today and at the end of each of the next five years into an investment account that is expected to earn a simple annual investment yield of 7% with quarterly compounding. At the end of the sixth year, you would like to take the first of seven consecutive annual withdrawals of $1,750. What do you expect for a remaining balance after the last withdrawal? (Answer: $8,132.49)

How do you feel about answering this TVM question (the same way twice)?

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Are You Nervous About Your Future as a Finance Professional? I’ve Been There!

Just to be clear, I haven’t been to your future! But I have worked in the field of finance.

For almost two decades, I commuted to work. My best friends know that I drive like a grandpa. If the speedometer ever hit 88 mph, I would have blamed it on too much coffee.

Photo by Brent Pritchard.

There’s something both extremely dangerous and memorable about 88 mph. Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

Here's a question that the above-average drivers will nail. Can drivers pass when there’s a solid line down the middle of the road? No, they can’t. This should remind you that you can’t move money along the solid timeline. It’s a Time Value of Money no-no to add or subtract or compare money in different points in time (on the timeline): TVM Rule #1.

To illustrate this point of time travel as it relates to the Time Value of Money, we can look to the Hollywood blockbuster Back to the Future starring the fictional character Marty McFly. In the movie, Marty McFly is able to travel back in time using a car that had been converted to a time machine thanks to a core component: the flux capacitor.

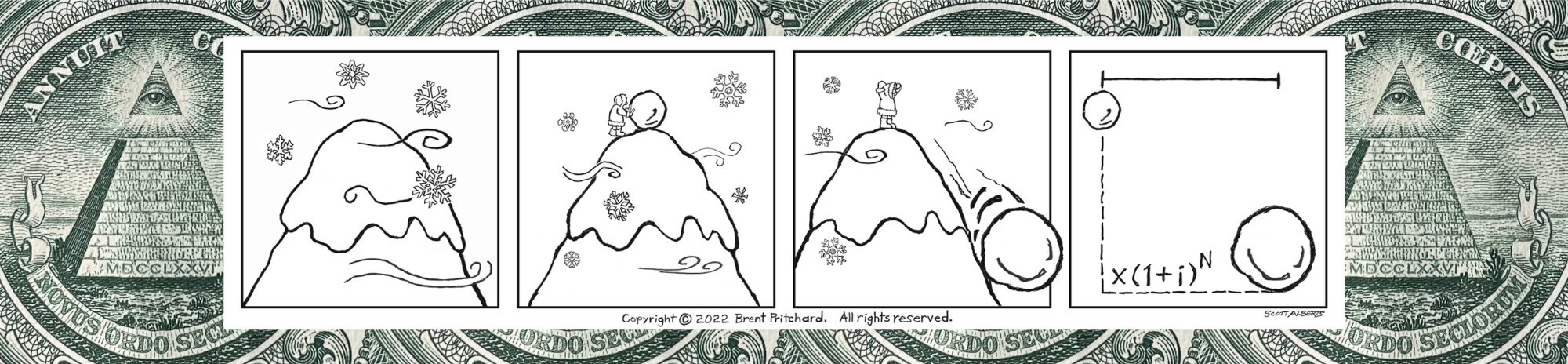

When it comes to the Mathematics of Finance, we don’t have a time-traveling Delorean, but aspiring and current finance professionals do have a handful of building block Time Value of Money equations permitting time travel for money by way of (1 + i)^N. This is why I refer to (1 + i)^N as the Flux Capacitor of Finance. (In the building block Time Value of Money equations for a perpetuity it takes the form of “i” or (1 + i); however, as described later, you could plug “9999” for the variable “N” in the building block Time Value of Money equations for an annuity and get the same answer you would when using the building block Time Value of Money equations for a perpetuity. And since the building block Time Value of Money equations for an annuity rely on (1 + i)^N, this mathematical expression really is the Flux Capacitor of Finance.)

Now I hope you can see how Marty McFly traveling through time with money in his pants pocket would have been a kind of violation of TVM Rule #1. It would have been better for him to recognize that there are markets for capital and to have invested the money before his rendezvous at the clock tower!

If you’re an aspiring finance professional, you’re going to do great things in your future. I’m sure of it.

As of this moment, there’s no way to go back in time. You owe it to yourself to understand how to apply the most important concept in the field of finance—which will help you in the classroom, in practice, or while sitting for an industry designation examination.

As a college finance lecturer, I’ve seen the deer-in-the-headlights look from students who thought they had the Mathematics of Finance figured out. That is, until real-world situations were presented.

How do you feel about your handle on the Time Value of Money?

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Get the Book Today!

Would Your Boomerang Return? provides a fun, new take on how the Mathematics of Finance is learned and taught:

All-in-one resource: all the important information on this all-important topic in one place with chapters in the What and How sections that double as individual lessons

Ease of reference: includes the first-of-its-kind user manual for the Mathematics of Finance with chapters named after sections typically found in an actual user manual for quick look up

Simple and definitive tool: 3-Step Systematic Approach for analyzing and evaluating real-world Time Value of Money situations

Decision-making framework: 23 real-world Time Value of Money questions, space to work out answers, and a "baseball count" system to evaluate understanding of the different types of questions

An easy read: complete with sprinklings of real-life stories and maybe even an ounce of inspiration here and there

Sign up for TVM 2$days, a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.