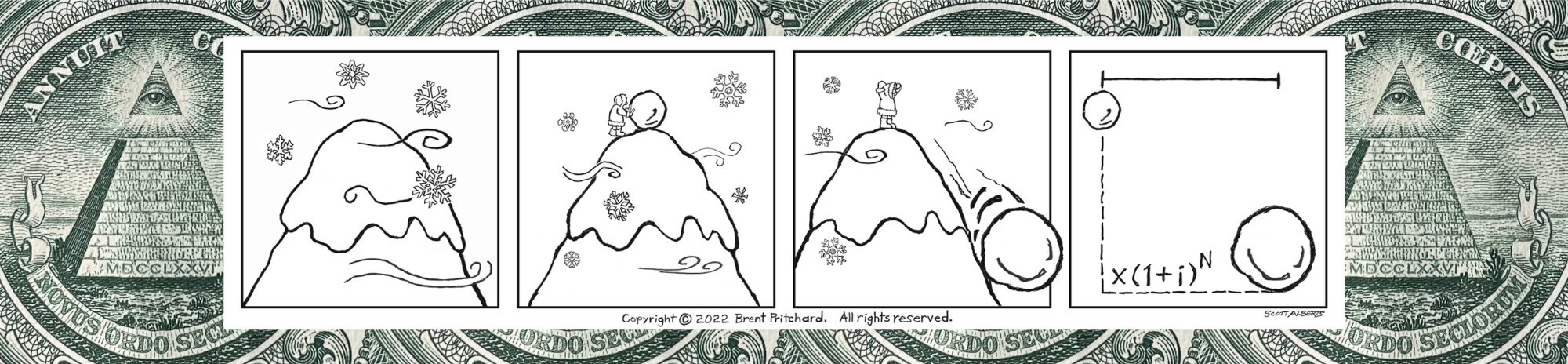

TVM 2$days

TVM Tuesdays is a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.

Sign up for email notifications:

Dollars and (Per)Cents.

You’ll work alongside some amazing people in finance. One of those people for me was (let’s just call him) Douglas Fairchild.

At his retirement party, myself and others got to hear some of the stories that can only be told after the fact. Like his opinion of a now former colleague and the hundreds of unread emails that he refused to open from this company officer who drove him crazy. This guy didn’t give a rip. That’s what having the kind of money that can best be described with two letters and being micromanaged can do to a person. If we’re being honest, each of us can probably think of one person whose emails we’d like to never open again.

Douglas was in the conference room the day the cat had the tongue of everyone in attendance. None could find the words to describe Net Present Value!

This image was created with the assistance of DALL·E and prompts from Brent Pritchard.

Are you a cat person or dog person? Can a person be both?

Speaking of both, NPV and i(RR) are usually analyzed side by side. But that doesn’t mean that both will always lead to the same decision.

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

As mentioned, we can’t ignore the issue of accretion to value, or the scale of economics of an investment opportunity, which is one of the benefits of the NPV metric. This illustrates why IRR Analysis and NPV Analysis go hand in hand. The left hand needs to know what the right hand is doing.

Finance professionals have different metrics at the ready to analyze and evaluate finance and investment decisions. The primary focus of this chapter is how cash flow influences return on investment or i(RR), but any discussion regarding i(RR) should also consider NPV. Some people like to unnecessarily overcomplicate things, and in the field of finance, I see lots of people doing this with NPV. It is simply the Present Value of the future expected cash flows minus or net of the Present Value of the investment. Remember that i(RR) is the (d)i(scount rate) that makes the Net Present Value of an investment equal to $0.

What words would you use to describe Net Present Value?

Brent Pritchard is an author and college finance educator with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

A “Whatwhywhich” for Takeaway.

My mentor, the guy who got me into running, has said that if he was stranded on a deserted island all he would need were avocados. Avocado is his superfood, but it isn’t the only superfood that is green.

Some people will tell you to “eat the rainbow” each day. That’s pretty good advice, I think. This is one way to eat your fruits and vegetables.

Then there are supplements, like AG1 (and done), if you want your vitamins and minerals in one package.

About supplements. I’m on a quest to condense my thoughts on resume bullet points into content that is easily digestible. I recognize that most resume bullet points are not going to follow the ROYGBIV Resume Bullet Point convention to a tee. For these and those who want a slightly different perspective, here’s a supplement, what I call the “Whatwhywhich”:

What (task did you perform)…?

Why (was that action needed)…?

Which (resulted in)…

It’s that which is sandwiched between the Skill and Experience on the resume.

Photo by Brent Pritchard.

Just like avocado isn’t the only superfood that is green, you might find that “that” or “resulting in” or some other word or combination is acceptable for your “greens.”

What greens are missing in your resume (or diet)?

Brent Pritchard is an author and college finance educator with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Finance Professionals Must Have Situational Awareness.

People who study and train in self-defense will tell you the importance of having situational awareness. If you’re not sure what this is, think scanning a dark parking lot as you walk to or from your car, understanding that it would be out of place for a person to be wearing a down jacket anywhere in the summer, and knowing the location of the exit as soon as you enter a building so to improve your chances of survival if stuff goes down. In short, it’s the ability to read the room or space you find yourself in, understand what’s what, and then how to effectively respond to a situation.

This image was created with the assistance of DALL·E and prompts from Brent Pritchard.

Here’s what’s not going to happen. The person intent on committing a crime or inflicting harm is not going to tap you on the shoulder and give you a heads up about what happens next.

In the classroom, finance students will raise their hands and ask me a question like, “Is this question asking for the ‘future value’ or something else?”

There are two things that employers dislike, three that are an abomination to them: self-righteousness, a lying tongue, and one who sows discord among team members.

One thing for all aspiring finance professionals must be true: awareness of the Time Value of Money. But you must know how to apply the Mathematics of Finance to analyze and evaluate real-world Time Value of Money situations.

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

Q14. In five years, you expect to have $60,000 in a savings account. Starting at the end of the sixth year and continuing through the end of the eleventh year, you expect you’ll be able to save $5,000 annually. At the beginning of the eleventh year, you will make annual withdrawals totaling $7,500 through and including the end of the twentieth year. Assume a true annual investment yield of 2.25% with quarterly compounding the first eleven years and a true annual investment yield of 2.00% thereafter. What do you expect to have for a remaining balance in your savings account twenty years from now?

If you got $28,590.19 then you can also answer the bigger question, “Do you have finance situational awareness?” with a response that would please a current or prospective employer.

What is the one thing that you feel holds you back when analyzing a real-world question, therefore making it a problem?

Brent Pritchard is an author and college finance educator with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Get the Book Today!

Would Your Boomerang Return? provides a fun, new take on how the Mathematics of Finance is learned and taught:

All-in-one resource: all the important information on this all-important topic in one place with chapters in the What and How sections that double as individual lessons

Ease of reference: includes the first-of-its-kind user manual for the Mathematics of Finance with chapters named after sections typically found in an actual user manual for quick look up

Simple and definitive tool: 3-Step Systematic Approach for analyzing and evaluating real-world Time Value of Money situations

Decision-making framework: 23 real-world Time Value of Money questions, space to work out answers, and a "baseball count" system to evaluate understanding of the different types of questions

An easy read: complete with sprinklings of real-life stories and maybe even an ounce of inspiration here and there

Sign up for TVM 2$days, a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.