TVM 2$days

TVM Tuesdays is a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.

Sign up for email notifications:

Finally Write Resume Bullet Points Right!

I’m done giving students their resume bullet points. Of course I’m going to continue to teach students some best practices related to the resume and the like. Like it or not (students), I’m going to help you finally write resume bullet points right!

I’m sure you’ve heard the following saying:

“Give a person a fish, and you feed them for a day; teach a person to fish and you feed them for a lifetime.”

You could say I’m done “helping” students fall short of their true potential, which can be realized when they fish around for the information needed to effectively tell their professional story.

Here’s an excerpt from the free bonus chapter to my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

You’re almost ready for the “hot seat.” First, let me share something that I have figured out from working in industry. The smartest people in the group have mastered the art of asking really great questions. So much so that they deliberately don’t ask you the question they really want to ask you. In other words, it’s the trailing unspoken question that may be of more interest to the interviewer. I’ve seen this done with such precision and excellence that I’m a little jealous of those who can do this with ease. After all these years in business, I can’t figure out if it’s the leadership skill in the person helping to lead the other to their way of thinking or if it’s because some people don’t like to be too direct. Might be a little of both, especially because of office politics and people wanting to climb corporate ladders.

The best leaders not only ask great questions of others, but also of themselves. You can employ this tactic to write effective resume bullet points.

But before you can do that, you need to call it like it is: a living document that can always be improved. This requires getting out of your own way: embracing that you are both a source of the problem and the solution. A great degree of agency can follow this realization.

Remember that the job of the resume is not to get you the job; rather, to get you the interview. The former comes down to skills and experiences!

How do you best tell your professional story one (bullet point) line at a time? By asking the right questions (of yourself):

What did you (do)…?

Why did you (do what you did)…?

How did you (know that your work produced a positive outcome)…?

These three bullet points will help you finally write resume bullet points right! Don’t believe me?! It’s this simple:

What did you do as a Stocker? I made sure product got from the warehouse to the retail floor.

Why did you move product from the warehouse to the retail floor? It was important that shelves which were emptied from the prior day’s sales be mostly restocked before the store opened and customers started to shop.

How did you know that your work produced a positive outcome? Working alongside others, we unloaded multiple pallets before the store opened, contributing to the customers’ shopping experience and daily store sales that averaged around $35,000.

Still not there? If you get stumped, you can also look at it from the employer’s perspective:

What were you hired to do?

Why is this role really needed?

How can the company stay in business?

This makes it crystal clear:

What were you hired to do? I was hired to unload pallets of merchandise and stock showroom shelves.

Why is this role really needed? To help the team and stock shelves in a timely manner.

How can the company stay in business? Keep customers happy and sell things!

Here’s how it all comes together (for the fictitious character Roy G. B. IV):

Copyright 2025 Brent Pritchard. All rights reserved.

(In case you missed it, the comma is indigo and the period is violet. Who can really tell the difference anyway?! Long story short, you don’t have to use a comma in the bullet point, just like you don’t have to use a period. This would result in our character being known as Roy G. B. or Roy G. B. I or Roy G. B. V: you get the point.)

The “leader” that is “Assisted” sets the tone for the rest of the resume bullet point. It’s pretty clear that this person wants to draw attention to the fact that they are a team player, someone who works well with others.

This is what I call the STARE tactic:

Skill

Task

Action

Result

Experience

(Green gets to the Result… You can’t make this stuff up!)

Are you sold yet? For the rest of the story on the resume and job-search process, check out the free bonus chapter:

How long did it take you to rewrite one of your resume bullet points using these (tailored) questions?

Brent Pritchard is an author and college finance educator with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

What Bang for the Buck?!

Growing up, I remember my Grandpa Schlieman and uncles bird hunting on the farm around the holidays. I never remember them deer hunting. I’m pretty sure venison sausage would have been one of my earliest memories.

I remember my first finance class like it was yesterday—both as a student and educator. Your first finance class is fertile ground for one-liners. You know the kind I’m talking about: risk requires return.

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

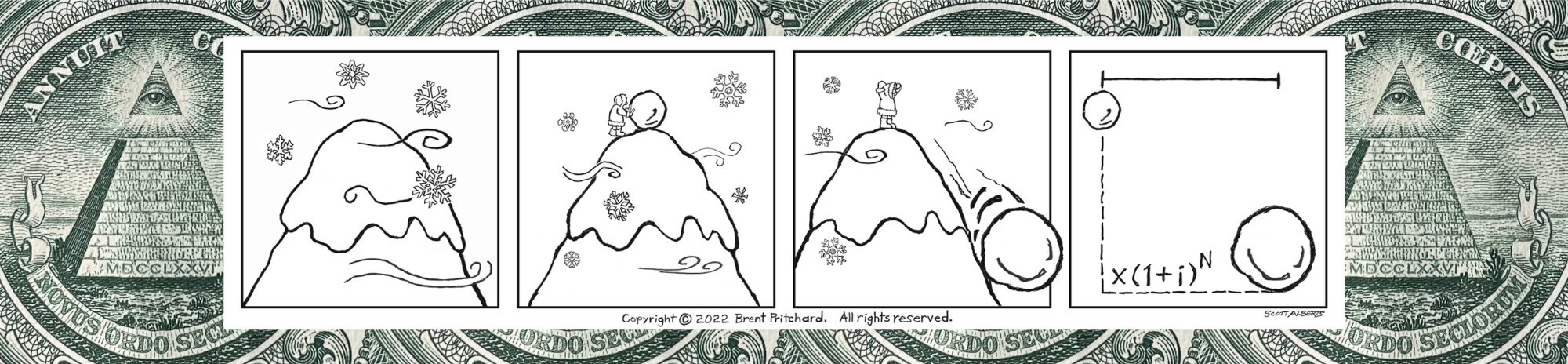

If compound investment yield is an investor’s best friend, time is a close second. In the Time Value of Money nomenclature, the expected return on investment or true investment yield is denoted with an “i.” It’s the exponent “N” that makes return on return on investment or compound investment yield possible. It’s because of the power of “N” that Albert Einstein reportedly thought that “Compound interest is the most powerful force in the universe.” Implicit in this statement is that he thought it was even more powerful than gravity, which ironically helped the smaller snowball roll down the mountain in the comic strip illustration!

The true investment yield or expected return on investment as denoted by “i” is not to be confused with Return on Investment (ROI). ROI doesn’t consider that money has time value. To illustrate this point, let’s reconnect with our “investor” from the last chapter who had a bird in the hand and was staring at two in the bush.

The ROI on a successful “bird investment” would have been 100%: two birds for one. But there was no mention of time. Was this investor hunter thinking that delaying consumption—this takes on a new meaning—of the bird in the hand was worth two in the bush…in twelve months? In other words, should 100% have been thought of as a true annual investment yield? Time is an important consideration when it comes to determining the true investment yield. See how ROI ignores time. ROI has application in practice, and there’s a time and a place for using this and other metrics to measure and evaluate potential investments. But it’s not in the context of the Time Value of Money.

Since ROI doesn’t consider that money has time value, it’s incompatible with the Mathematics of Finance. ROI is a simple measure of return. When we dive deep into the discussion regarding the true investment yield, you’ll discover that the word simple or nominal is used to describe an investment yield that doesn’t consider the effects of compounding.

So if the investment metric ROI isn’t “i,” then what is? That would be the Internal Rate of Return (IRR or as I like to write it, i(RR)). The i(RR) is the discount rate that sets the Present Value of the future expected cash flows over the investment period equal to the investment. Unlike ROI, i(RR) is Time Value of Money approved! The time span of the i(RR) must correspond with the time span in between the periods or payments (on the timeline). For example, if the time span in between period markers on the timeline represents annual periods, then the i(RR) is a true annual investment yield. A product of the finance industry, of course i(RR) is going to consider time.

And if that’s not enough, here’s the starter:

Photo by Brent Pritchard. Copyright 2023 Brent Pritchard. All rights reserved.

What is your earliest memory from a finance class(room)?

Brent Pritchard is an author and college finance educator with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Finance Students, Watch Out for This Red Flag.

When your time comes, I hope you get the chance to work with a living legend in your industry like the opportunity my former colleagues and I had.

There were lots of things that made the man special. One was his intuition. “Never make a loan to a person who drives a red sports car.” Why? Because they’ll never make the first payment: true story. He not only had a tremendous amount of smarts but a smile that made people smile and stories that made them belly laugh. Two that come to mind are the “Elk Meat” story and the one about the borrower who chose not to lay into him because the man thought he had brought his son, a coworker who shared the same last name but no relation, to the face-to-face meeting.

A woman, who will remain nameless, who works as a waitress has learned to watch out when a child orders the filet. Why? Chaos will ensue: you’re likely to get “talked up to.” Whether the meat is red or not on the inside, this gets to the same point: learn from past experiences.

This image was created with the assistance of DALL·E and prompts from Brent Pritchard.

A red flag in finance is that many aspiring finance professionals, dare I say most, don’t know how to manipulate the investment yield. (You can insert “interest rate” if you haven’t yet been enlightened by the fact that a non-interest bearing asset can also potentially compound.)

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

Before Clayton John made the trek to Cedar Rapids, Iowa, financial calculator in hand, responding to the job posting he saw in the Wall Street Journal and would later get, he was a high school math teacher in Albert City, Iowa.

I love this story for a lot of reasons. First and foremost, it showcases an important sequence that many people outright ignore. First comes the math, then comes the finance.

What do you estimate for the true quarterly investment yield based on an effective annual interest rate of 10.3813% with monthly compounding? (The answer isn’t 2.5953% and it’s definitely not 3.4604%, nor is it 2.6178% and it’s definitely not 3.5056%. It’s 2.5%.)

Brent Pritchard is an author and college finance educator with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Get the Book Today!

Would Your Boomerang Return? provides a fun, new take on how the Mathematics of Finance is learned and taught:

All-in-one resource: all the important information on this all-important topic in one place with chapters in the What and How sections that double as individual lessons

Ease of reference: includes the first-of-its-kind user manual for the Mathematics of Finance with chapters named after sections typically found in an actual user manual for quick look up

Simple and definitive tool: 3-Step Systematic Approach for analyzing and evaluating real-world Time Value of Money situations

Decision-making framework: 23 real-world Time Value of Money questions, space to work out answers, and a "baseball count" system to evaluate understanding of the different types of questions

An easy read: complete with sprinklings of real-life stories and maybe even an ounce of inspiration here and there

Sign up for TVM 2$days, a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.