TVM 2$days

TVM Tuesdays is a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.

Sign up for email notifications:

You Heard It Here First: Merry Christmas!

As we celebrate the “Happy Holidays,” I hope I’m one of many to wish you a “Merry Christmas.” Tis the season to take a little time off work, which reminds me of one of my favorite things to find in a legal document when I was practicing real estate:

“[Intentionally left blank]”

Not many people would call the act of reviewing complex legal documents fun like playing the guitar, for example. Notwithstanding anything to the contrary, here’s something one can’t help but love to read (after tearing through wrapping paper):

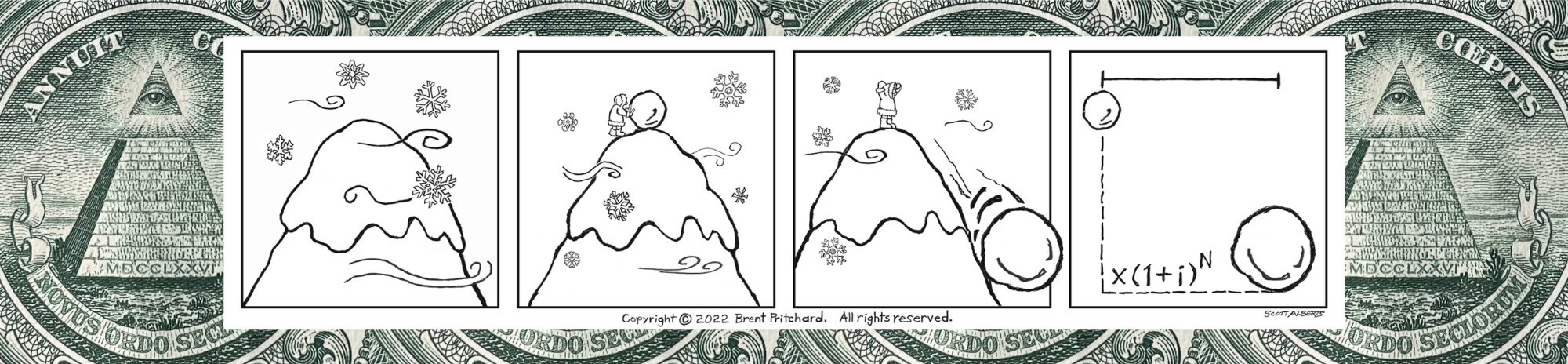

Photo by Brent Pritchard.

How do you plan to celebrate with the gift that comes from Nazareth?

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

1.21 Gigawatts!

It was in an accounting class all about debits and credits that I figured out I wanted to study finance. Before I became a finance professional, I also had to take that economics class where it seemed like every day all they talked about was widgets. Since not everyone earns or spends in US dollars, it’s about time we had a name for an unnamed currency in finance that fits the bill. Enter the gigawatt.

I know, I know, a gigawatt is a unit of power. But I wouldn’t know that, and it might not ring a bell for you, had it not been for the Hollywood blockbuster Back to the Future. This movie was an instant classic.

In an introductory finance class, a classic first example that communicates the power of compound “interest” might be presented as follows (in the gigawatt currency):

1.00 gigawatt

10% interest rate (what I can’t help but specify is the true investment yield)

2-year investment period

This example assumes that there are no recurring payments (other deposits or withdrawals) over the investment period. (See why the word interest is so last year: there is a spectrum of investments, some that pay interest and some that don’t, which is why investment yield is a better way of thinking about return on investment.)

Copyright 2024 Brent Pritchard. All rights reserved.

What do you estimate for the future value of a 1.00 gigawatt investment after two years assuming a 10% true annual investment yield? 1.21 gigawatts!

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Time Is Ticking.

Do you value time over money or money over time? How might you be able to tell…?

Would you invest in a graduate program that in, say, two years’ time could potentially lead to a sizable bump in the amount of money you are able to take home every month or save?

Or, without a second thought, if given the opportunity would you trade all the money in the world to turn back the clock to spend just a little more time with a loved one who has passed, make things right with a child or parent…(fill in the blank with whatever currently haunts you)?

Lots of people pursue a path similar to the one described above. Some have the good fortune of a priceless (no money required) second chance.

What’s stopping you from doing either or both today (or one day before it’s too late)? (Today is a day we don’t get to live twice as the name somewhat suggests.)

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Get the Book Today!

Would Your Boomerang Return? provides a fun, new take on how the Mathematics of Finance is learned and taught:

All-in-one resource: all the important information on this all-important topic in one place with chapters in the What and How sections that double as individual lessons

Ease of reference: includes the first-of-its-kind user manual for the Mathematics of Finance with chapters named after sections typically found in an actual user manual for quick look up

Simple and definitive tool: 3-Step Systematic Approach for analyzing and evaluating real-world Time Value of Money situations

Decision-making framework: 23 real-world Time Value of Money questions, space to work out answers, and a "baseball count" system to evaluate understanding of the different types of questions

An easy read: complete with sprinklings of real-life stories and maybe even an ounce of inspiration here and there

Sign up for TVM 2$days, a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.