TVM 2$days

TVM Tuesdays is a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.

Sign up for email notifications:

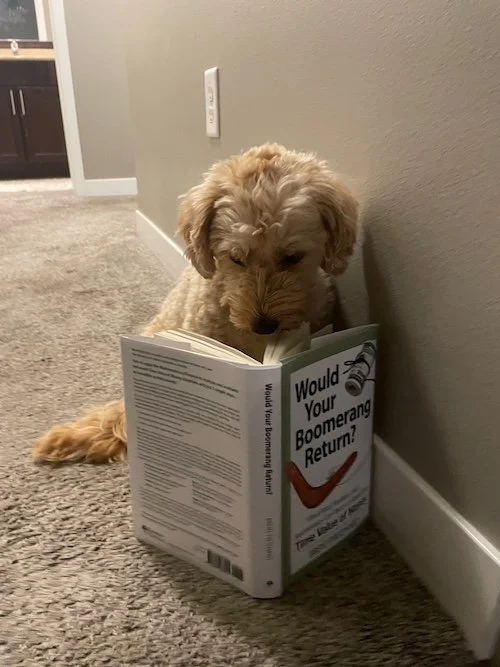

Dogs Think This Book Is Too Good to Eat!

I don’t think it’s a coincidence that dog is God spelled backward. The love of a dog is close to, if not, perfect. While dogs may not be all-knowing, they are very smart (and they know a good book when they see one, which might explain why they eat people’s homework if they want their people to also feed their brains):

Photo by Brent Pritchard.

Do you like to receive and read letters? Have you ever thought about the fact that the most popular salutation is spelled with the same letters that describe what you’ve been asked to do?!

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

Here is something that is not openly acknowledged or talked about that often: LTV is overrated. The LTV metric doesn’t consider the Cap Rate (CR). Unfortunately, we can’t combine these two acronyms to form a word that will help you remember to avoid this pitfall without “buying” a few vowels. By adding “Y” and “E” and “O” to the mix, we can spell “covertly,” which speaks to how deceptive LTV has been for so many people over the years. Let’s not repeat this history. Be a yeoman and remember that Debt Yield (DY) is a better metric from the lender’s perspective, since it considers the amount of mortgage capital and thus is the approximate cap rate that would lead to the return of investment.

This text is from Chapter 3, which is where I weave in some knowledge from my days as a real estate professional to help bring the topic to life for the reader.

What investment metric didn’t seem to exist prior to the Great Recession that everyone (and their dog) was saying after? (Hint: It’s not LTV or CR.)

Brent Pritchard is an author and college finance educator with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

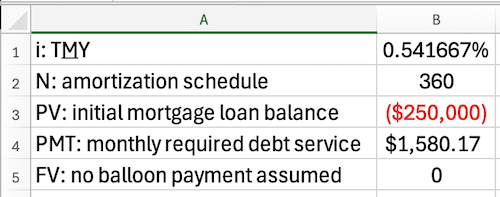

For Finance Professionals Interpreting Inputs Is Key.

The most popular question in a classroom might be, “Will this be on the test?” A close second in a finance class just might be, “Can we use Excel on the exam?”

But what good is Excel if an aspiring finance professional can’t interpret the five primary TVM (financial calculator) inputs? This is where one needs more than one acronym to describe the variable. Enter the colon:

Photo by Brent Pritchard.

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

I feel the need to let you know that I’m not anti-spreadsheet; however, I’m a big proponent of using financial calculators and longhand math, as needed, to analyze and evaluate real-world Time Value of Money situations.

It always makes me laugh when one of my students—even if the student has experience in the industry—tries to tell me that financial calculators are rarely used anymore. Are you kidding me?

In my former life, with the help of Peter Dailey and others like him, our shop regularly originated an annual CML volume around $2 billion. We put those deals together using mostly pens or pencils, paper, and financial calculators.

I’ve heard all sides of the argument: one can’t email work product using a financial calculator. I didn’t say that we didn’t use computers and spreadsheets. But real money managers use financial calculators. My experience is that people who use an HP-12C have likely been around the block a time or two. I’m just saying that the “Fincalc” is the original Fintech, and they’re far from out of favor!

How well do you know the TVM keys on your financial calculator? (You’ll be using them in practice!)

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Will the Gig Line or Timeline Get You the Gig?

How many times have you heard someone say, “It’s not what you know, it’s who you know.” Do you really believe that?!

Since we’re one-third the way there, let’s continue with the 5 W and 1 H (questions). How well do you know the Mathematics of Finance? Why did you pick this line of work? And the question you hope to hear: When do you want to start?

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

I mean it when I tell my students that I wouldn’t hire a finance professional who doesn’t understand the Time Value of Money like the back of their hand. Trent Farley, who is one of my favorite people and the only person I’ve ever worked with who could finish my sentences—we were that much on the same wavelength—can attest that my go-to interview question is, “How do you describe the Time Value of Money in your own words?”

If you’re an aspiring finance professional, there’s no question you’ve worked with a timeline.

But “Where do you draw the gig line?” is a question you may want to answer before stepping into an interview?

This image was created with the assistance of DALL·E and prompts from Brent Pritchard.

(And if you’re worried about AI replacing you, in addition to a timeline, at least you can actually “draw” a gig line!)

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Get the Book Today!

Would Your Boomerang Return? provides a fun, new take on how the Mathematics of Finance is learned and taught:

All-in-one resource: all the important information on this all-important topic in one place with chapters in the What and How sections that double as individual lessons

Ease of reference: includes the first-of-its-kind user manual for the Mathematics of Finance with chapters named after sections typically found in an actual user manual for quick look up

Simple and definitive tool: 3-Step Systematic Approach for analyzing and evaluating real-world Time Value of Money situations

Decision-making framework: 23 real-world Time Value of Money questions, space to work out answers, and a "baseball count" system to evaluate understanding of the different types of questions

An easy read: complete with sprinklings of real-life stories and maybe even an ounce of inspiration here and there

Sign up for TVM 2$days, a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.