TVM 2$days

TVM Tuesdays is a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.

Sign up for email notifications:

Will the Gig Line or Timeline Get You the Gig?

How many times have you heard someone say, “It’s not what you know, it’s who you know.” Do you really believe that?!

Since we’re one-third the way there, let’s continue with the 5 W and 1 H (questions). How well do you know the Mathematics of Finance? Why did you pick this line of work? And the question you hope to hear: When do you want to start?

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

I mean it when I tell my students that I wouldn’t hire a finance professional who doesn’t understand the Time Value of Money like the back of their hand. Trent Farley, who is one of my favorite people and the only person I’ve ever worked with who could finish my sentences—we were that much on the same wavelength—can attest that my go-to interview question is, “How do you describe the Time Value of Money in your own words?”

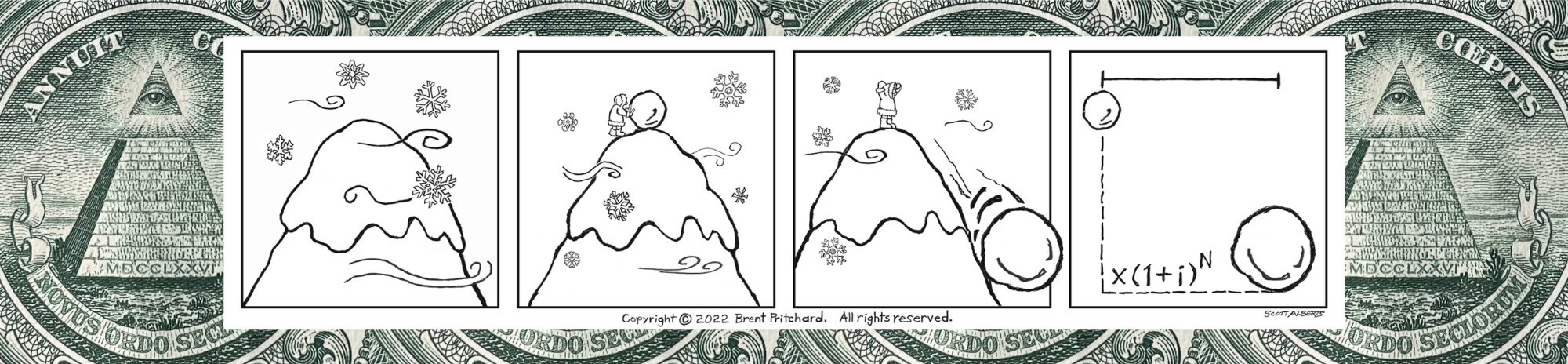

If you’re an aspiring finance professional, there’s no question you’ve worked with a timeline.

But “Where do you draw the gig line?” is a question you may want to answer before stepping into an interview?

This image was created with the assistance of DALL·E and prompts from Brent Pritchard.

(And if you’re worried about AI replacing you, in addition to a timeline, at least you can actually “draw” a gig line!)

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Finance Students Are So Over Overcomplicated!

It’s that time of year. This month, people are fetching their Pumpkin Spice Lattes. Next month, turkeys will be running for their lives while runners sign up for local Turkey Trots. On campuses around the world, students are busy studying for midterm exams.

Photo by Brent Pritchard.

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

If you’ve ever participated in a race, then you know that there’s a total race time also called the chip time, and your average pace per mile. ROI is the equivalent of the total race time, that is the time from when your foot crossed the start line to when you cross the finish line. Do you see the problem with only providing someone with your total race time? When you sign up for a race you sign up for a distance, not a time. The time comes later. In this example, the only information this other person has is your chip time but no idea what distance you ran. For example, 5K, 10K, etc. Just as chip time is dependent upon distance, more information is needed to help someone make sense of the result.

On the other hand, i(RR) is like the runner’s average pace per mile. The average pace per mile provides information that can be interpreted and analyzed, regardless of the distance of the race. If the only race distance in the world was a one-miler, then the total race time and average pace per mile would be the same. But we know that foot races cover a wide variety of distances. Some are super short, such as a kids’ fun run, where participants are rewarded with cookies on the other side of the finish line. Race length goes all the way to ultramarathon endurance events covering 100 miles or more. Runners in these endurance events don’t usually have to wait until crossing the finish line to find treats, which are typically stocked at aid stations along the route.

Photo by Brent Pritchard.

Why do you think traditional finance textbooks are so overcomplicated?

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Are You a Passive-Aggressive Investor?

When I accepted a faculty position, in addition to swapping an office in Corporate America for a classroom, I traded a thirty-minute one-way car commute for a two-and-a-half-mile trip to campus. Thirty miles each way might not sound like much. But I made that commute for over twenty years! Two days ago, as I was commuting on my bike something happened (I wouldn’t exactly call it sidewalk rage) that got me thinking.

Photo by Brent Pritchard.

I had left church and would later realize that I had also left my helmet and water bottle behind. As I rode up a sidewalk in an unfamiliar direction, I noticed a couple walking ahead of me. I usually take the bike path on the road when I’m riding down the one way. Didn’t feel right to ride against traffic. That and I wasn’t wearing a helmet, so on the self situational awareness scale I was already on code orange.

As I passed this nice couple, I heard the man make a comment under his breath. I’ll let you use your imagination to choose how this ended similar to those books you may have read when you were younger. I will say that kind words were spoken. (Remember, I was coming from and going back to church.)

This got me thinking. Is passive-aggressive behavior really a bad thing? Bear with me. The word aggressive can carry a negative connotation, but I choose to focus on directness. In my mind, it sure beats the alternatives: passive or aggressive.

Now to money matters. And let’s flip the script. An “aggressive-passive” investment approach is characterized by one’s stretching to make those predetermined deposits (maybe early in life) when there isn’t much money coming in, so that later on that same person can passively watch their investments portfolio grow over time. I’d call a “passive” investment approach one where someone is waiting for others to save them from their financial doldrums. On the other hand, an “aggressive” investment approach is pedal to the metal investing. Not a bad thing if you can balance life and its responsibilities. Those loved ones you leave behind will thank you. Using these definitions, a “passive-aggressive” investment approach involves time wasted.

When are you going to put your money where your mouth is?

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Get the Book Today!

Would Your Boomerang Return? provides a fun, new take on how the Mathematics of Finance is learned and taught:

All-in-one resource: all the important information on this all-important topic in one place with chapters in the What and How sections that double as individual lessons

Ease of reference: includes the first-of-its-kind user manual for the Mathematics of Finance with chapters named after sections typically found in an actual user manual for quick look up

Simple and definitive tool: 3-Step Systematic Approach for analyzing and evaluating real-world Time Value of Money situations

Decision-making framework: 23 real-world Time Value of Money questions, space to work out answers, and a "baseball count" system to evaluate understanding of the different types of questions

An easy read: complete with sprinklings of real-life stories and maybe even an ounce of inspiration here and there

Sign up for TVM 2$days, a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.