TVM 2$days

TVM Tuesdays is a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.

Sign up for email notifications:

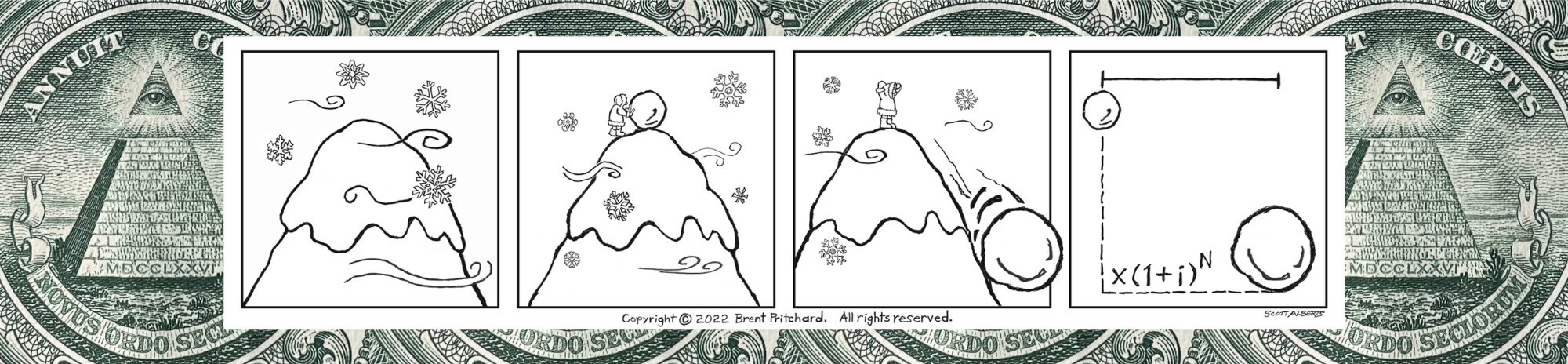

I Take You to Be My Lender, I Promise to Pay You Interest or a Prepayment…Premium.

It may take two to tango, but it’s only going to take one borrower or mortgage banker (who forgets what life was like before receiving the lender’s money) to get fired up from this one.

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

All investors are focused on yield, whether or not investment yield takes the form of interest. For proof of this, we need look no further than loan documents and a provision that is commonly included and titled “Yield Maintenance.” It’s not called “Interest Maintenance,” even though interest is the form most, if not all, of the yield takes for the loan.

A mortgage lender may require that a borrower pay yield maintenance (aka a prepayment premium) if the loan is prepaid early to compensate the lender for the loss of the bargained-for yield. Again, not “bargained-for interest.”

And for the record, it’s not a “prepayment penalty.” One of many lessons real estate attorneys have taught me is that one can only get what another has to give. A lender gives a borrower the right to prepay the mortgage loan, and as a result, the borrower gets the flexibility that comes with holding an option.

Investors pay a premium for an option. In the case of a CML, the borrower controls whether to exercise the option and thereby prepay the loan. The agreement is governed by the loan documents that describe this right, among others, and create the bargained-for deal. Some people like to refer to the lender–borrower relationship as a “two-way street,” but I prefer the roundabout visual. It’s not the initial give and get that defines the relationship as much as it is the agreement that the getter will give and the giver will get. That’s what makes it come full circle. In the example, the getter received a right or option—but don’t stop short, there’s more—based on what was bargained-for. If the option is exercised, the only thing the getter can give is what was received, which is the bargained-for right to pay the required prepayment premium.

Still not convinced the correct term is prepayment premium? Are you a borrower?! If you still insist on calling it a “penalty” then know that it’s a penalty from the lender’s perspective. I know the argument: “But our profit from the sale of the real estate will be reduced to the extent of the prepayment premium.” That’s right, it will. And that’s why a holder of a traditional put option is willing to pay a premium that just might cut into their profit. Given the zero-sum nature of options, when the right is exercised one investor’s premium will result in another’s penalty.

Why would you break a (promissory note) promise and not call it what it is: a prepayment premium?

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

The Professional Development Opportunity College Finance Students Don’t Take Advantage Of.

If I were interviewing nowadays, in addition to my go-to interview question I would ask, “What is the best book you’ve read lately?” Why? Because someone who doesn’t truly care about learning and growing professionally is, well personally, someone I don’t want on my team.

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

I mean it when I tell my students that I wouldn’t hire a finance professional who doesn’t understand the Time Value of Money like the back of their hand. Trent Farley, who is one of my favorite people and the only person I’ve ever worked with who could finish my sentences—we were that much on the same wavelength—can attest that my go-to interview question is, “How do you describe the Time Value of Money in your own words?”

This question predated the publication of this book but like this book gets to the heart of the matter: whether a professional is qualified for a position in finance. Now prospective employers and prospective clients have a tool to gauge an aspiring or current finance professional’s understanding of this all-important topic. My go-to interview question has been replaced with the “Pop (Open the Back Cover) Quiz.” What’s more expensive, testing one’s comprehension and ability to apply the Mathematics of Finance in service of customers or members by using this book in the vetting process or potentially making the wrong hiring decision?

In fact, we might be onto something. And just like that, I hand the baton on. Who will pick it up? I’m guessing a reader, since it’s been said that “leaders are readers.”

Want a resume builder? I’ll give you one! Consider establishing the Business Book Association student organization at your business college (or at the national level, provided this idea or the trademark isn’t taken already) to help aspiring finance professionals further promote their Bachelor of Business Administration (BBA) degree.

This image was created with the assistance of DALL·E and prompts from Brent Pritchard.

Back in the day, I was like many college finance students who didn’t make time to read (for myself). Whether this was a result of being so over traditional textbooks that were oh so boring is a conversation for a different day. But know that there was a day (not long after I accepted a position in industry) when I realized that real finance professionals are serious readers.

There’s no reason why aspiring finance professionals should wait to become readers (again), especially if that is going to potentially help them get an edge up on the competition. And yet, this appears to be the way it is. This doesn’t make it right! Prepping for an interview starts well before one even knows they have an interview scheduled.

What are you doing today to position yourself for your (future) dream job? (I hope I get the opportunity to come by your chapter of the Business Book Association someday!)

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

There’s an “i” in “Finance Team.”

I used to work with someone who looked forward to the (payoff) day when he could say, “return on, return of” when a commercial mortgage loan his team had originated moved off the funding report.

There is obviously a difference between the two. The “on” refers to return on investment, what others might call IRR: Internal Rate of Return. Personally, I prefer the acronym and like to write it “i(RR)” since it is the true investment yield and because the full name includes the word of (which can be confusing when drawing the distinction between return on investment and return of investment).

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

The two most popular return metrics are ROI and i(RR). Think of them as the two most popular in school—they are in business colleges. Have you had the experience of hearing someone’s name and thinking to yourself, With a name like that, so-and-so is destined for stardom? That’s the way I first felt about ROI. The one thing that ROI has going for it is a great name that includes the word on. Three words, none wasted for this investment metric. Investors invest for “return on investment.”

Aside from the cool name, we’ve already discussed how ROI doesn’t consider time. I’m sure you know someone who has no regard for time. It’s annoying. You want dependability and not to be left hanging.

On the other hand, if i(RR) were a person, it would be the one you would want to bring home to meet the parents. Nobody living today is perfect. The same is true for measures to evaluate a potential investment. The shortcomings—yes, you read the plural correctly—for i(RR) will be discussed in the next chapter. But I still love “i(RR),” and so should you. Don’t let the name fool you. ROI has nothing to do with return on investment as we think about true investment yield or “i” in the context of the Time Value of Money.

How would you describe i(RR)—to a friend?

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Get the Book Today!

Would Your Boomerang Return? provides a fun, new take on how the Mathematics of Finance is learned and taught:

All-in-one resource: all the important information on this all-important topic in one place with chapters in the What and How sections that double as individual lessons

Ease of reference: includes the first-of-its-kind user manual for the Mathematics of Finance with chapters named after sections typically found in an actual user manual for quick look up

Simple and definitive tool: 3-Step Systematic Approach for analyzing and evaluating real-world Time Value of Money situations

Decision-making framework: 23 real-world Time Value of Money questions, space to work out answers, and a "baseball count" system to evaluate understanding of the different types of questions

An easy read: complete with sprinklings of real-life stories and maybe even an ounce of inspiration here and there

Sign up for TVM 2$days, a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.