TVM 2$days

TVM Tuesdays is a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.

Sign up for email notifications:

It Takes Time, Value, and Money.

The year was 1995. All was well in The Hawkeye State. That’s when I received an important lesson, which came in the form of a Post-it Note:

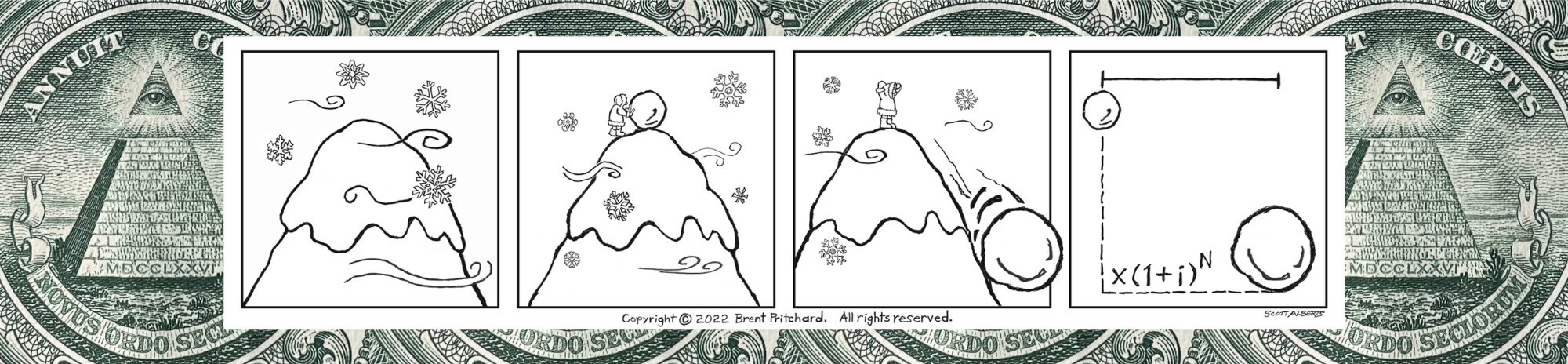

If compound investment yield is an investor’s best friend, time is a close second. But we can’t forget about money.

It’s expected that money when invested over time will increase in value, which ultimately stems from the true investment yield.

The true investment yield when considered with time, (1 + i)^N or what I like to call the Flux Capacitor of Finance, is the value activator since time alone doesn’t bring about more value for money.

What variables in the building block Future Value equation represent Time, Value, and Money? (Hint: left to right isn’t the only way to read variables.)

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

AI AI Oh, F#@%!

Twenty-two years is a long time to do anything. That was my tenure in Corporate America, where as a friend says I was able to “find a niche and crawl into it.”

As a commercial real estate finance professional, I remember when Amazon started the big move to develop its last mile delivery infrastructure. Let’s just say that more than one request for financing for a fulfillment center they would occupy crossed by desk.

As a lending platform, we could like Amazon’s credit at the same time as seeking out deals with Amazon-proof tenants. Think retail centers occupied with service companies in the business of nails and the like or with outparcels where people served up McDonald’s.

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

Rounding out this new take on the Time Value of Money is a simple and definitive 3-Step Systematic Approach for applying the Mathematics of Finance, which has benefits as it relates to analyzing and evaluating real-world Time Value of Money situations from the classroom to the boardroom and in between.

Brent, you’re saying that finance professionals can also benefit from this content?! That’s right! Before I traded in my office in Corporate America for a classroom, I remember one day when the cat had the tongue of not only a very seasoned finance professional but also everyone else in the room. None could find the words to describe Net Present Value!

I’m not the first, nor will I be the last, to draw a comparison to the world that is arguably better post-internet and what the future of business with AI might hold. I, for one, think the result will be net positive.

This image was created with the assistance of DALL·E and prompts from Brent Pritchard.

What will the “finance professional” who can’t analyze or interpret NPV do for a job? (At some time in the future, somewhere there will be an old MacDonald who has a farm…and on that farm they will have a cat, AI AI Oh….)

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

The Time Value of Money Trifecta.

Simplicity. Consistency. Connectivity. Before these words were inked, they were the unspoken rules of engagement for the mental project that later became a physical book.

I’ve written about the TVM Rules before. If you were thinking about writing them off, take a look at them with a fresh set of eyes. If you’re new to this blog or haven’t read my book Would Your Boomerang Return?, maybe this is the first time you’ve heard about these original TVM Rules.

This image was created with the assistance of DALL·E and prompts from Brent Pritchard.

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

Doing any of these is a Time Value of Money no-no:

Add or subtract or compare money in different points in time.

Fail to correspond the time span in between periods or payments (on the timeline) and the time span of the true investment yield.

Neglect to consider different payment types and signs.

The order is on purpose and by design, because it gives us the mnemonic indifferent that helps us easily remember the three TVM Rules. Below, instead of finding the “no-no” language, you’ll find a few minor and inert changes, including the words Time and Value and Money, to get you thinking about how the TVM Rules can also be remembered by recalling “Time,” “Value,” and “Money,” in that order:

Time: Consider money in different points in time.

Value: Correspond the time span in between periods or payments (on the timeline) and the time span of the true investment yield.

Money: Consider different payment types and signs.

Let’s once again reframe the TVM Rules, this time to include the five primary TVM financial calculator keys and the variables in the building block Time Value of Money equations:

N: money in different points in time.

i: correspond the time span in between periods or payments (on the timeline) (n) and the time span of the true investment yield; and

PV, PMT, and FV: consider different payment types and signs.

This is what I call the Time Value of Money trifecta!

How’s that for simplicity?

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Get the Book Today!

Would Your Boomerang Return? provides a fun, new take on how the Mathematics of Finance is learned and taught:

All-in-one resource: all the important information on this all-important topic in one place with chapters in the What and How sections that double as individual lessons

Ease of reference: includes the first-of-its-kind user manual for the Mathematics of Finance with chapters named after sections typically found in an actual user manual for quick look up

Simple and definitive tool: 3-Step Systematic Approach for analyzing and evaluating real-world Time Value of Money situations

Decision-making framework: 23 real-world Time Value of Money questions, space to work out answers, and a "baseball count" system to evaluate understanding of the different types of questions

An easy read: complete with sprinklings of real-life stories and maybe even an ounce of inspiration here and there

Sign up for TVM 2$days, a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.