TVM 2$days

TVM Tuesdays is a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.

Sign up for email notifications:

What Do You Fear More: Flying or Flying Blind With Money?

First-time visitors who have stumbled across this blog are in for a treat. This is the corner of the internet where Time Value of Money lessons are communicated with stories that relate to real-world situations.

Take today for example. “It’s not every day that one flies to London” was the sentence that I had planned to write before a delay left me typing this post at O’Hare at 12:58 AM. (What follows is what I had planned to share from my outpost, but it still works. And that’s good, because I’m tired. No coffee in sight!) Yesterday, when we were driving to the airport and in between thoughts of how much I’d miss my family and dogs, it occurred to me that the topic of the next blog post was a no-brainer. Such a trip deserves a storyline about flight.

Photo by Brent Pritchard.

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

Actually, the four forces of flight relate to the topic of the Time Value of Money. “Does it fly?” in the context of flight comes down to drag, thrust, weight, and lift. Drag refers to the force that pulls things backward. Thrust refers to the force that pushes things forward. Weight refers to the force that pulls things down. Lift refers to the force that pushes things up. In the context of the Time Value of Money, we can think about discounting as drag, compounding as thrust, the hurdle rate as weight, and NPV as lift. While there are four forces of flight, lift is the outward sign of flight. In the context of the Time Value of Money, a positive NPV is the signal that an investment opportunity will “fly.” A pilot’s preflight check can be likened to a finance professional needing to double-check his or her math.

What would it take to find insights and new in the “old,” and where might that train of thought take you?

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

For Recent College Finance Graduates the End Is the Beginning.

I was planning on letting last week’s post season a bit before venturing back into part two of my thoughts on Beg. Mode. But it seemed fitting given that this is a time of transition for many. I’m referring of course to the graduation season. Congrats to the grads!

For those graduates going into a career in finance, can you name this calculator?

Photo by Brent Pritchard.

If not, and if your newest opportunity involves banking of any kind, that’s about to change. Notice the slight modification I made recently. Who knew about this alternative use for a paper clip?

Why would I want to do this (and deface my financial calculator by scraping away reference to Beg. Mode)? One word. Consistency. I like being able to tell you that for an annuity there’s a relationship between “N” and “PMT” as it relates to both inputs for the financial calculator and variables for the relevant building block Time Value of Money equation.

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

The end of one period is the same as the beginning of the next period. Imagine you’re bringing in the New Year in New York City. For a split second, when the ball drops and it starts raining confetti, the end is the beginning. On the timeline, period marker 1 represents the end of the first period and the beginning of the second period, and so on and so forth.

We can expand this thought and say that the beginning of the timeline, which is represented by period marker 0, also represents the end of a prior period. Nobody ever taught me this in school, but you can add “real estate” to the leftmost side of the timeline. That’s right: period marker -1.

Why would you want to do this (and add a period marker -1 to a timeline)? Because when you ignore Beg. Mode like I do, and when you’re running the numbers to solve for the present value of an (even) annuity, your financial calculator will be providing you with a value as of one period before the first payment is to be made. If you need the value as of period marker 0 then you’ll be using the FV key to get you the answer that you could double-check using the Building Block Present Value of an Annuity Due equation. This is what I call a “two-step” operation.

When I typed “The End” in the manuscript that would later become the book Would Your Boomerang Return? I made sure to also type “: The Beginning” on that last line. Will I write another book? My answer might surprise anyone who hasn’t had the opportunity to experience a creative, all-consuming project. It was a gift. And gifts are received. So, we’ll see. I don’t know at this time. But what I do know is that never in my wildest dreams would I have ever imagined that I’d be an author, a college finance lecturer, a husband to a great mom, a dad…. I’d never finish this post if completion of such a list were a prerequisite.

What surprises would you welcome before “The End” of your life, and since you’ve given your dream a name what are you waiting for?

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

“In the Beg…Mode Is Trouble!”

Where do I…begin? I got it! With a question that I think about a lot. Why would you use Beg. Mode?!

Let me just say that this post won’t likely be the end of my rant on Beg. Mode. In fact, I’ve got another one teed up for the future. But you’ll have to wait for that one.

This image was created with the assistance of DALL·E and prompts from Brent Pritchard.

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

This “Good to Know” takes a slightly different form. You need to know that I’ve heard of the financial calculator Beg. Mode; however, I’m not a fan. Why don’t I recommend using Beg. Mode?

First, I like that I can tell you that “N” will always represent the number of consecutive payments for an even annuity that are subject to the same true investment yield and the same time span in between payments (on the timeline)—regardless of when the first payment is made.

Beg. Mode is inconsistent with this definition as it relates to the building block Future Value of an Ordinary Annuity equation since its version of “N” considers the number of consecutive payments less one: the amount of the even annuity payment would need to be added manually to determine the FV(OA).

Consistency is one key to success in life, so it seemed appropriate to set you up for success as you go about applying the Mathematics of Finance to analyze and evaluate real-world Time Value of Money situations. Using Beg. Mode and needing to remember to manually add the amount of the even annuity payment to ultimately determine the Future Value of an Ordinary Annuity would be a solution in search of a problem.

There is tremendous value to a principled approach. That’s why Dave Ramsey’s program for helping people get out of debt is so successful. Once the Baby Steps are memorized, you know what to do. And when it comes to budgeting, every dollar has a name. It’s genius. Dave Ramsey is so smart that he was able to take the brain out of personal finance. Stick to the principled approach, and you’ll do just fine.

Second, it’s easy to forget to switch back to End Mode. This is like being one question off on a standardized test. Not good.

By way of example, say you’re trying to figure out the FV(OA) three years from now for a series of four investments of $1,000, assuming a true annual investment yield of 5% and that the first deposit is made today with subsequent deposits on each anniversary. The below Building Block Future Value of an Ordinary Annuity equation allows you to double-check the answer. You might be thinking, Why not use the Building Block Future Value of an Annuity Due equation? Or, Shouldn’t I be using the Building Block Future Value of an Annuity Due equation because the first payment is made at the start of the investment period? The reason we use the Building Block Future Value of an Ordinary Annuity equation is because moneys are not “working” to earn a return after the last payment is deposited. This is a key point. And then there’s consistency: the fact that “N” will always represent the number of consecutive payments for an even annuity that are subject to the same true investment yield and the same time span in between payments.

Why do you feel comfortable using Beg. Mode if you haven’t memorized all of the Building Block Time Value of Money equations to double-check your work? (There are seven more where these came from.)

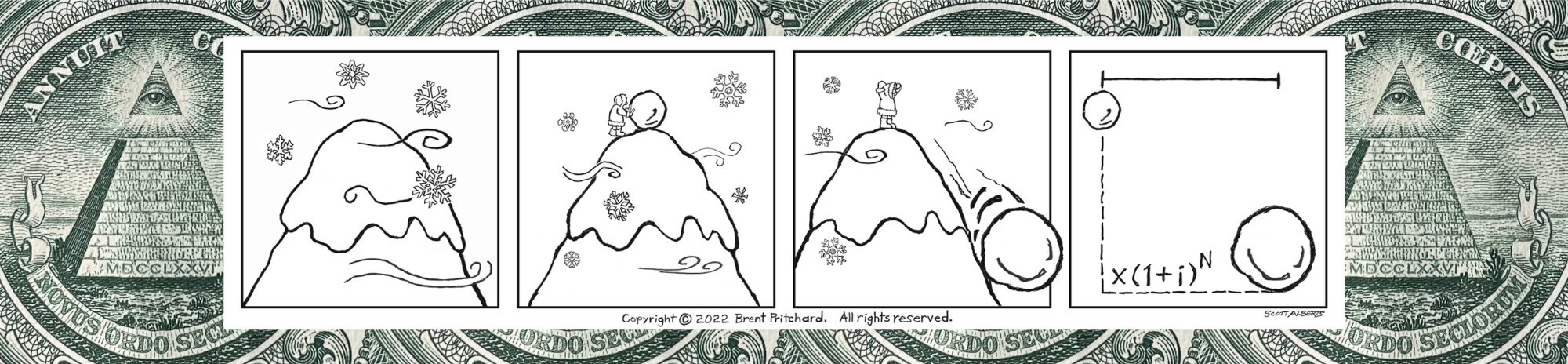

Illustrations by Scott Alberts. Copyright 2022 Brent Pritchard. All rights reserved.

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Get the Book Today!

Would Your Boomerang Return? provides a fun, new take on how the Mathematics of Finance is learned and taught:

All-in-one resource: all the important information on this all-important topic in one place with chapters in the What and How sections that double as individual lessons

Ease of reference: includes the first-of-its-kind user manual for the Mathematics of Finance with chapters named after sections typically found in an actual user manual for quick look up

Simple and definitive tool: 3-Step Systematic Approach for analyzing and evaluating real-world Time Value of Money situations

Decision-making framework: 23 real-world Time Value of Money questions, space to work out answers, and a "baseball count" system to evaluate understanding of the different types of questions

An easy read: complete with sprinklings of real-life stories and maybe even an ounce of inspiration here and there

Sign up for TVM 2$days, a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.