TVM 2$days

TVM Tuesdays is a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.

Sign up for email notifications:

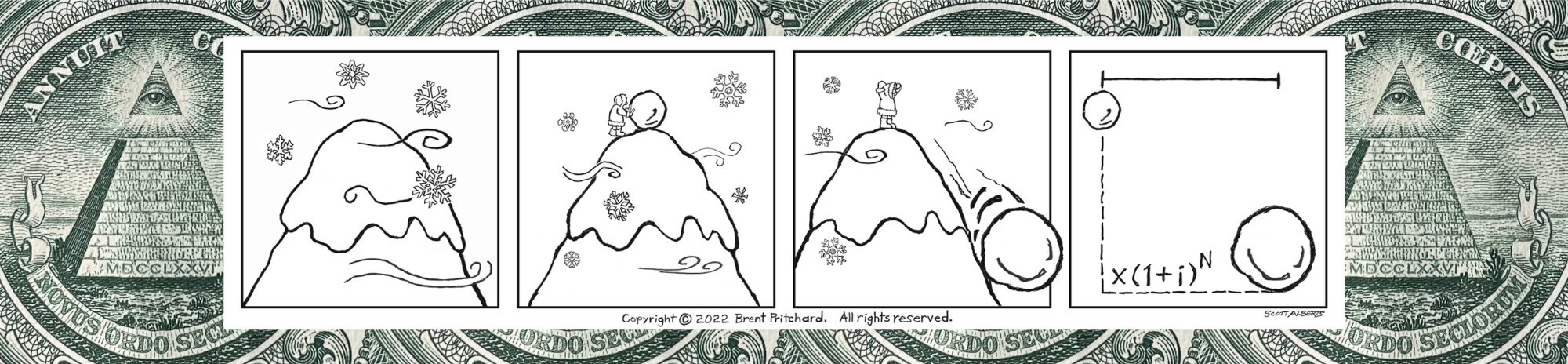

Finance Professionals Who Can’t Measure Twice or Double-Check Their Work Might Get Cut Once Others Are Onto Them.

One day on my run-commute home I noticed something interesting. This wasn’t meant to be an exploratory run. Although those are fun, this was just another run down a street I’d covered many times before. For any other passerby, what I had stumbled across might be thought of as just another hole in the ground. As for me, I couldn’t have asked for a better teardown since it was this imagery, complete with steps leading to nowhere, that I have used to describe the bigger problem with respect to the Time Value of Money. So, I took a breather and snapped a picture.

Photo by Brent Pritchard.

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

With gatekeeper publishing houses having developed the blueprint, the content relating to the Time Value of Money in most publications is cookie-cutter. It was in industry literature—papers not books—where I found PhDs or PhD candidates attempting to “enter through the back door.” This is where I found attempts to develop systems to provide aspiring and current finance professionals with a method for applying the Mathematics of Finance.

Since my area of expertise is in real estate, that’s how I tend to see the world. Traditional textbook publishers had attempted to lay the footings as it relates to the Time Value of Money, but it was as if they had put the house together before the foundation was ready and with missing parts.

Those in academia who had identified part of what I call the “big problem” deserve a pat on the back. It was their work that helped me further see the need for this book. But their attempts at developing a go-to systematic approach left much to be desired. It was as if they were laying the steps by a big hole in the dirt where the foundation should be—instead of building from the ground up. The gaping hole I found in these attempts was that each one lacked definitive steps. Much of what I found consisted of flowcharts with questions that instead of leading to an answer seemed to raise more questions, which is a problem!

What started as a search for a better resource to help my students master the concept of the Time Value of Money ended with my typing “The End” and this book being published for a bigger audience.

Between these two points in time, I embarked on what people in the real estate industry like to refer to as a “tear down and rebuild” project. People buy houses that are complete and structurally sound. Custom homes are built from the ground up. The main components of a house that I want to zero in on for this illustration are the footings, foundation, frame, walls, roof, picture windows, and steps.

Now let’s put this in terms of the Time Value of Money. The footings represent the original TVM Rules based on the mnemonic indifferent. The foundation represents the improved building block Time Value of Money equations. Some people reading this will know that foundation walls were once predominately built with cinder blocks, hence the placement of the building block Time Value of Money equations in this illustration. The frame represents the “Need to Knows.” The walls represent the “Good to Knows.” The roof represents having all the important or essential information on this all-important topic in one place. The picture windows represent the visual aid that is the TVM Wallet. And last but not least, the steps represent the simple and definitive 3-Step Systematic Approach.

Simply put, I put myself in the shoes of someone who had never before been introduced to the Time Value of Money and asked myself the question, “How would I like to have learned about the Mathematics of Finance?” This question served as the North Star for this project that had me wearing a student’s shoes and an architect’s hat.

The age-old fundamentals remain; however, the holistic perspective and 3-Step Systematic Approach will help aspiring and current finance professionals apply the Mathematics of Finance with confidence to analyze and evaluate real-world Time Value of Money situations—in the classroom, in practice, or while sitting for an industry designation examination. This how-to manual for the Time Value of Money will position you such that you can double-check your work using little more than a pen or pencil, paper, and basic calculator functions.

How many traditional textbooks do you think it would take to backfill such a hole in the ground? (Don't assume that such a parcel was left on the parcel, but I’m just saying.)

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Have You Struck Out Before Practicing in the Field of Finance?

Who doesn’t love baseball? Or a day at the ballpark? It’s America’s National Pastime.

Recently, I was able to spend some time with my friend and mentor, Whitt, over lunch. We hadn’t seen each other in person for the better part of a year. So, we had some catching up to do. I wasn’t surprised when the conversation turned to his beloved Houston Astros. He’s been a lifelong fan.

This image was created with the assistance of DALL·E and prompts from Brent Pritchard.

From what I can tell, there isn’t a set list of rules for the Time Value of Money in the finance industry. It’s not like there’s a TVM governing body like there is in the MLB (Major League Baseball). “For [there are] one, two, three…TVM Rules that every aspiring and current finance professional must know.”

I hope you’re thinking, TVM Rules! Not, TVM Rules?

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

The Time Value of Money is commonly abbreviated TVM. It’s worth noting the Time Value of Money shorthand because it consists of three letters. Just like there are three letters in TVM, there are three TVM Rules. As you’ll see later, the dialing in of these original TVM Rules extends beyond being minimalistic. Spoiler alert: the first relates to Time, the second to Value, and the third to Money. Now isn’t that a novel idea? It actually is, which means it was long overdue. Doing any of these is a Time Value of Money no-no:

Add or subtract or compare money in different points in time.

Fail to correspond the time span in between periods or payments (on the timeline) and the time span of the true investment yield.

Neglect to consider different payment types and signs.

Visit a baseball field on game day, and you’ll see a lot more than balls and bats. If you saw someone with only a ball and bat walking to a ball field, you might think they’re ill-prepared. If you saw someone with all the baseball getup walking to a football field to practice, you’d be right to think they’re getting ready to practice in the wrong field.

Similarly—and this one really hits home—you wouldn’t want someone to tell you that you’re not well suited for practicing as a finance professional, or worse yet, that you’re practicing in the wrong professional field.

Learning a sport starts with learning the fundamentals. The most fundamental part of the Time Value of Money is comprehension of the TVM Rules. One of the first ways that you can prove to yourself—not yet others at this point—that the finance field is right for you is comprehension of the TVM Rules.

Numerous times, I’ve heard of interviewers asking aspiring finance professionals about the Time Value of Money while they’re in the hot seat.

Why should anyone hire an aspiring finance professional who “strikes out” with respect to the Time Value of Money (Rules)?

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Does the Mathematics of Finance Feel Like a Foreign Language?

Math is a kind of language. As if that’s not enough, within the field of finance there’s all kinds of terminology. Some of you might recognize what follows.

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

So, terminology. Let’s start with a phrase that many aspiring and current finance professionals can recite. “A dollar today is worth more than a dollar tomorrow.” But we’re not concerned with the Time Worth of Money. There’s no reference in the Mathematics of Finance to Present Worth and Future Worth; instead, Present Value and Future Value.

Investors are indifferent between values of money in different points in time because there are markets for capital. Investors expect to earn an investment yield, which compensates them for delaying consumption, opportunity cost, and for taking on exposure to risk including the risk of inflation. Even if investors don’t deploy or invest cash, they must recognize that they could. The presence of investment alternatives keeps investors in the right state of mind which considers that money has time value. If there are markets for capital that consist of equity, debt, and hybrid investments then what’s all this talk about compound interest? Why not compound yield or compound investment yield? There are more places to invest money than just checking and savings accounts, money market instruments, and bonds that return interest.

Finance professionals are well aware of the relationship between price and yield, but nobody is talking about the price that is expected to generate a certain interest. There’s a difference between return on investment and return of investment, yet when we get to the point of estimating return on investment, are you scratching your head as to why we’re not using the investment metric (ROI) that consists of the same words: rather, the Internal Rate of Return? That’s confusing!

Photo by Brent Pritchard.

What words would you use to describe the Mathematics of Finance? (Must include less than or more than four letters!)

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Get the Book Today!

Would Your Boomerang Return? provides a fun, new take on how the Mathematics of Finance is learned and taught:

All-in-one resource: all the important information on this all-important topic in one place with chapters in the What and How sections that double as individual lessons

Ease of reference: includes the first-of-its-kind user manual for the Mathematics of Finance with chapters named after sections typically found in an actual user manual for quick look up

Simple and definitive tool: 3-Step Systematic Approach for analyzing and evaluating real-world Time Value of Money situations

Decision-making framework: 23 real-world Time Value of Money questions, space to work out answers, and a "baseball count" system to evaluate understanding of the different types of questions

An easy read: complete with sprinklings of real-life stories and maybe even an ounce of inspiration here and there

Sign up for TVM 2$days, a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.