TVM 2$days

TVM Tuesdays is a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.

Sign up for email notifications:

Your Finance Instructor Should Say “Thanks” for Giving Them This Question: Happy Thanksgiving!

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

SWOT vs. DRAMS Analysis: Is the Glass Half Full or Half Empty?

Where the numbers of the Mathematics of Finance leave off, there are words to describe what makes an investment opportunity tick. In the real estate industry, this is what people refer to as the deal’s “story.”

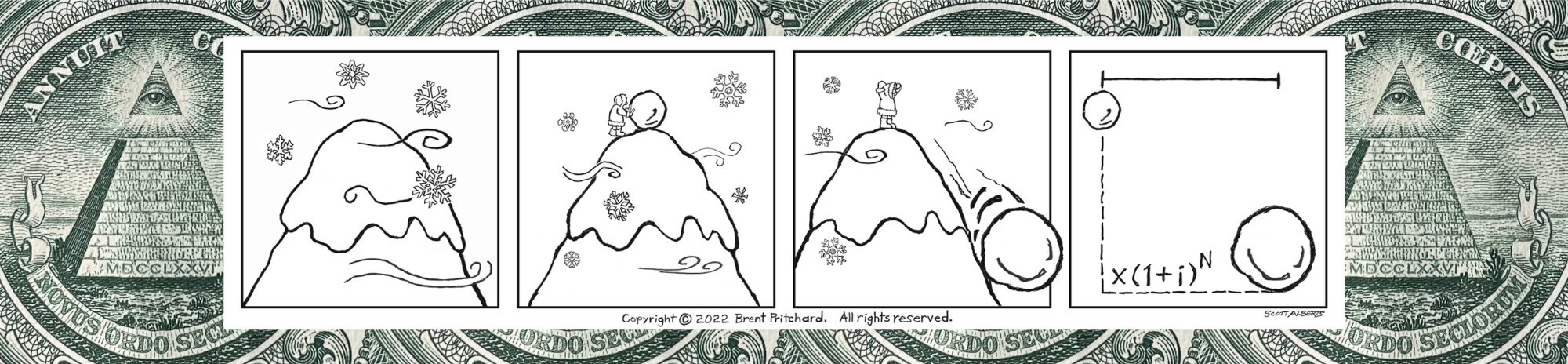

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

Having cut my teeth in underwriting and credit analysis, I’m well aware that “It’s easy to lend, but hard to get paid back.” That’s why it’s been said that “Lenders wear belts and suspenders.” If you don’t like the visual of what those accessories are trying to keep from exposing, “Surprises are for birthdays” gets the same point across.

This is also why I tend to see the glass half empty. This is a pretty typical (former) lender’s view.

Photo by Brent Pritchard.

I’m guessing you’ve probably heard of the “5 C’s of Credit.” They provide a great general framework for underwriting a financing opportunity.

I’ll do you one better (in the spirit of the glass being half empty). Aspiring and current (real estate) finance professionals would do well to think in terms of DRAMS Analysis:

Downside: What is the single biggest risk at the property or loan level that you have identified through due diligence which if left unaddressed would likely result in an event of default?

Risk: What other risks have you identified through your analysis, regardless of whether they were referenced in the financing proposal? (Some mortgage bankers would do themselves a favor to see things from the lender’s point of view, which just might get them to the closing dinner where now the question relates to a wineglass.)

Address: How is the downside risk addressed through sizing, structuring, pricing, or enhancing? (What I call the “4 ings” of commercial real estate financing.)

Mitigants: How, in your opinion, are the other risks mitigated or managed based on historical or anecdotal information, space market fundamentals, analysis of the competitive set, comps, and the like?

Strengths: What are the biggest strengths you see as it relates to the subject property and the hypothetical mortgage loan request?

This framework was developed in the commercial real estate industry; however, it can be used for any situation that involves financial analysis. For example, you can substitute “offering memorandum” for “financing proposal” or “investment opportunity” for “mortgage loan request” if that better describes your situation. Regardless of the words used, the approach is the same.

The glass half full people have SWOT Analysis. DRAMS Analysis is a risk management framework, which as an added benefit tempers any tendency to be too salesy when it comes to the written or verbal presentation for the financing or investment opportunity. This is the kind of communication executives appreciate. “Present and advise, the client decides.”

Fun fact: You don’t know how excited I was when I developed this framework years back and learned that a dram is a unit of measurement for a liquid (like water in the glass that’s half empty).

What’s stopping you from incorporating DRAMS Analysis into your underwriting or due diligence today (other than the glass half full people who like their water and SWOT Analysis)?

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Who (You Know) Is on First.

In addition to helping aspiring finance professionals grasp the concept of the Time Value of Money like the backs of their hands, I also coach finance students. The other day, I was talking with an individual about their job-search process. It was from that conversation that this week’s blog post was inspired.

If you’re in any field long enough, it’s almost inevitable that you will have a manager (or a manager’s manager) who is batshit crazy. Such is life. But that’s not a reason to get discouraged. People are people. Some are (in fact) crazy. Others might simply be conflicted with your personality.

“The game must go on,” were wise words from Franklin Roosevelt who was referring to a desire to keep professional baseball going during World War II. This quote provides general inspiration for trials you will no doubt encounter in your professional life.

The game of baseball, in particular, provides a metaphor for the job-search process and an easy way to see where, if at all, you are off base and in what areas you might improve your efforts. As you study the baseball illustration that follows, it will help to keep the following things in mind:

You can’t get to second base without first touching first base, and so on and so forth.

It only takes one connection between bat and ball for a batter to become a baserunner—but there is such a thing as a pinch runner if you’re not the best at making connections.

A professional is within “scoring position” at second base—with a resume that tells your professional story and speaks to your marketable skills as well as your unique value proposition (between its bullet point lines).

The “Hot Corner” as it’s known must be rounded to reach home plate—just as prospective employers require that you complete an application.

Leading off the bases is not required—but things like: 1) relevant experience makes a resume better; 2) a cover letter makes an application better; and 3) interviewing skills improve your chances of getting an offer and making your job search a home run.

What you know is more important than the Who you know…who’s on first…?

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Get the Book Today!

Would Your Boomerang Return? provides a fun, new take on how the Mathematics of Finance is learned and taught:

All-in-one resource: all the important information on this all-important topic in one place with chapters in the What and How sections that double as individual lessons

Ease of reference: includes the first-of-its-kind user manual for the Mathematics of Finance with chapters named after sections typically found in an actual user manual for quick look up

Simple and definitive tool: 3-Step Systematic Approach for analyzing and evaluating real-world Time Value of Money situations

Decision-making framework: 23 real-world Time Value of Money questions, space to work out answers, and a "baseball count" system to evaluate understanding of the different types of questions

An easy read: complete with sprinklings of real-life stories and maybe even an ounce of inspiration here and there

Sign up for TVM 2$days, a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.