TVM 2$days

TVM Tuesdays is a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.

Sign up for email notifications:

There’s an “i” in “Finance Team.”

I used to work with someone who looked forward to the (payoff) day when he could say, “return on, return of” when a commercial mortgage loan his team had originated moved off the funding report.

There is obviously a difference between the two. The “on” refers to return on investment, what others might call IRR: Internal Rate of Return. Personally, I prefer the acronym and like to write it “i(RR)” since it is the true investment yield and because the full name includes the word of (which can be confusing when drawing the distinction between return on investment and return of investment).

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

The two most popular return metrics are ROI and i(RR). Think of them as the two most popular in school—they are in business colleges. Have you had the experience of hearing someone’s name and thinking to yourself, With a name like that, so-and-so is destined for stardom? That’s the way I first felt about ROI. The one thing that ROI has going for it is a great name that includes the word on. Three words, none wasted for this investment metric. Investors invest for “return on investment.”

Aside from the cool name, we’ve already discussed how ROI doesn’t consider time. I’m sure you know someone who has no regard for time. It’s annoying. You want dependability and not to be left hanging.

On the other hand, if i(RR) were a person, it would be the one you would want to bring home to meet the parents. Nobody living today is perfect. The same is true for measures to evaluate a potential investment. The shortcomings—yes, you read the plural correctly—for i(RR) will be discussed in the next chapter. But I still love “i(RR),” and so should you. Don’t let the name fool you. ROI has nothing to do with return on investment as we think about true investment yield or “i” in the context of the Time Value of Money.

How would you describe i(RR)—to a friend?

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Are You Ready for a Career in Finance?

Classrooms are full of finance students who can recite the statement “A dollar in the present is worth more than a dollar in the future.” But there’s a big difference between comprehension of the Time Value of Money and application of the Mathematics of Finance.

You want to know the biggest problem I see in the classroom? It’s cheating, but not in the way you might expect. Aspiring finance professionals are cheating themselves by thinking that comprehending the above statement is knowledge of the Time Value of Money. It’s not even in the ballpark!

There’s a reason our Introductory Unit on the Time Value of Money includes 28 lessons—the equivalent of two lessons for each word in the above statement! You can check out the playlist at TVM Rules.

I blame the teacher in me for putting the below QR code on the back of my business card. If you’re an aspiring or current finance professional, you should have no problem correctly answering these three real-world Time Value of Money questions:

Photo by Brent Pritchard.

Who would you rather hire: someone who can recite 14 words or apply the Mathematics of Finance?

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

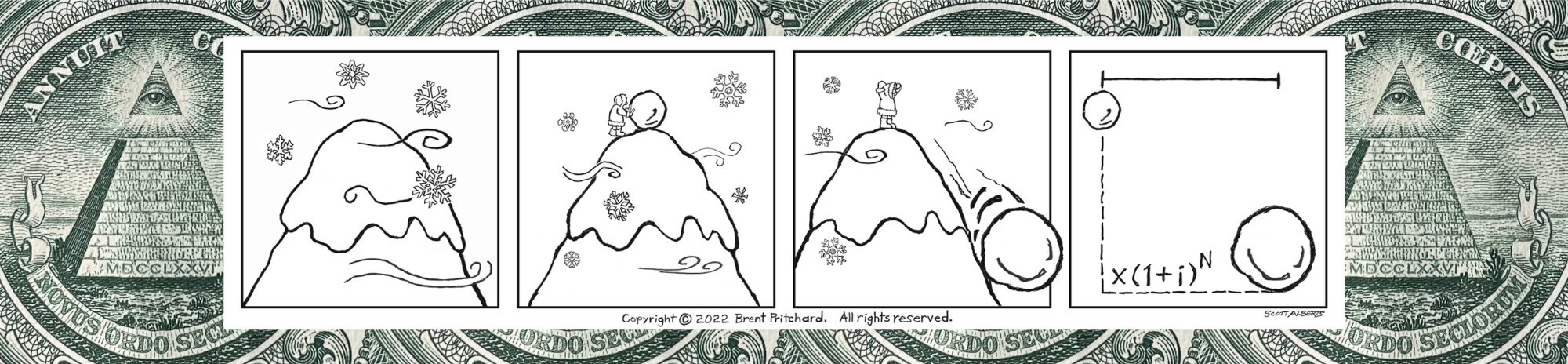

A Picture Worth 3 Words!

Who needs 1,000 words, when 3 adequately describe this picture?!

Value is one of the words; however, it’s not associated with 1,000 or FV.

What are the other 2 words? (Hint: “of” isn’t one of them. See the Time Value of Money doesn’t need to be hard!)

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Get the Book Today!

Would Your Boomerang Return? provides a fun, new take on how the Mathematics of Finance is learned and taught:

All-in-one resource: all the important information on this all-important topic in one place with chapters in the What and How sections that double as individual lessons

Ease of reference: includes the first-of-its-kind user manual for the Mathematics of Finance with chapters named after sections typically found in an actual user manual for quick look up

Simple and definitive tool: 3-Step Systematic Approach for analyzing and evaluating real-world Time Value of Money situations

Decision-making framework: 23 real-world Time Value of Money questions, space to work out answers, and a "baseball count" system to evaluate understanding of the different types of questions

An easy read: complete with sprinklings of real-life stories and maybe even an ounce of inspiration here and there

Sign up for TVM 2$days, a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.