TVM 2$days

TVM Tuesdays is a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.

Sign up for email notifications:

The Art of Finance.

The other day, something interesting happened at Mass. I was one of a few ushers who were standing in the back. Being an usher this particular Sunday was about as easy as it is on Christmas or Easter, but not because all the seats were taken. Quite the opposite. This was dead week for sports, a time when there are no practices or workouts, etc. A time when many families finally get to pack their bags and leave for a much anticipated summer vacation. The hands on my watch read a couple minutes before 11 a.m. A quick scan of the church revealed large groups of empty seats.

People continued to arrive, but that’s when I noticed something I didn’t expect. When I told a man, “You can sit wherever you’d like” I saw this blank look on his face as he stood gazing over the sea of empty seats. On a normal Sunday, when church is packed, I would have found this man and his child one of the few remaining seats that were together and helped them to their row. Instead, this man stood there looking at all the places he could sit and didn’t know where to call it home for the next hour. Then a woman appeared. Like clockwork, she did the same thing! It’s no exaggeration that it probably took them longer to think about where to sit than to actually walk to their seat and sit down once it had been found. I couldn’t believe it. It was crazy!

I don’t know the first thing about how the human mind words, but in that moment I couldn’t help but think that there must be certain situations where people like to be directed.

Then it occurred to me. This is exactly what many aspiring finance professionals encounter as they sit in their seats in the classroom. They are overwhelmed because they may not know the steps that need to be taken to answer a question. This is where the 3-Step Systematic Approach and the TVM Wallet come in:

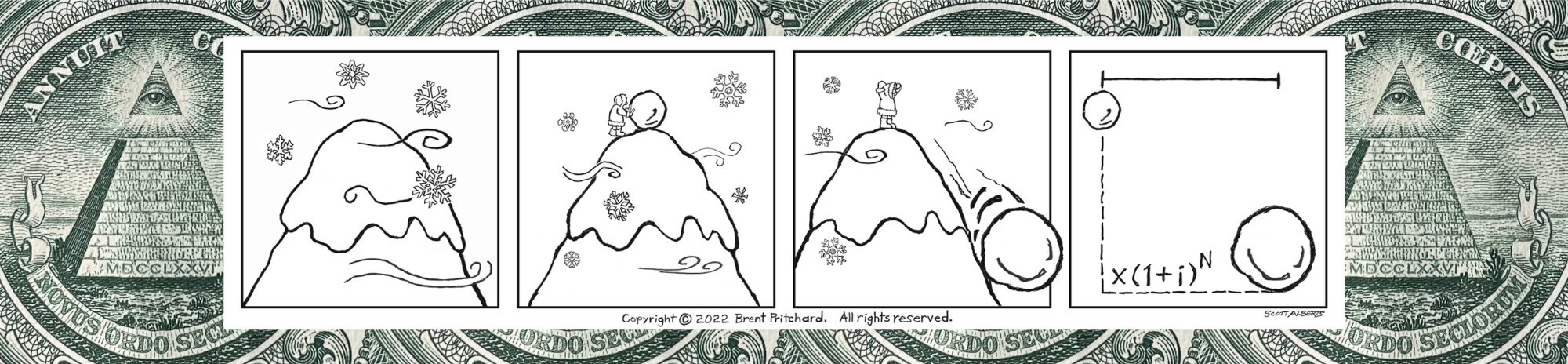

Illustration by Scott Alberts. Copyright 2022 Brent Pritchard. All rights reserved.

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

I’m with the majority of students who associate with being visual learners. The code was cracked when I realized that the original TVM Rules, which are based on the mnemonic indifferent, also provide the blueprint for the 3-Step Systematic Approach that is applied using the visual aid that is the TVM Wallet and which allows you to succinctly step out the process of applying the Mathematics of Finance in such a way that promotes confidence through a repeatable system.

The Time Value of Money provides you with the opportunity to find your inner artist. Okay, not really, but there is drawing involved. I’ve yet to meet a person who can’t draw stick people, and the timeline is even more basic than that. It really does help to draw a timeline, which is a visual representation of when you expect certain amounts of money to be invested or received.

Who knew that there was drawing in finance?! The 3-Step Systematic Approach, which is executed using the TVM Wallet, is the solution for analysis paralysis as it relates to applying the Mathematics of Finance to analyze and evaluate real-world Time Value of Money situations.

What is the one thing about the Mathematics of Finance that gives you or others analysis paralysis?

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

TVM Rules.

They matter. And yes, it does!

Word of mouth is still and will always be the best form of marketing. (Even a finance instructor knows that!) Will you please help us spread the word about our YouTube channel, TVM Rules, and the book, also known as the “Boomerang book,” that made it possible?

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

You’ve likely purchased—and had delivered to your house—one or more products that came with parts to assemble, a user manual, and a simple tool. Have you ever had the unfortunate circumstance of opening a box only to find that one or more pieces are missing? It happens from time to time and crushes your ambition. But presumably every one of the user manuals you’ve ever handled has provided all the important or essential information needed. Many user manuals include multiple languages. In this case, the first thing you need to do is locate your language. What good are instructions if the words don’t make sense? While some are far easier to read than others, there aren’t many user manuals out there that require you to go elsewhere because they are incomplete. A company selling a product that repeatedly didn’t include in the box all the pieces that would allow the owner to use the item, including a complete manual and the simple tool, would no doubt get bad reviews and wouldn’t likely be in business for long.

I wouldn’t expect you to think otherwise, yet that’s exactly what I’d found in the market with respect to the content related to the Time Value of Money! The product in the box, more precisely the Time Value of Money content within these other books, was missing pieces of information.

Now I’m a pretty practical guy with a good amount of common sense or street smarts. Having worked in industry, I know that quality work product requires adherence to a certain standard of excellence. This is why restaurants have to dish out good food to stay open for business. Word of mouth is still and will always be the best form of marketing or anti-marketing. So it’s beyond me how these other providers of content on the topic of the Time Value of Money can continue to dish out a product that leaves people with a bad taste in their mouths.

What would it take for you to like our videos, subscribe to our YouTube channel, or tell a friend (maybe even a child-friend) about TVM Rules? What if I told you that your support will ultimately help aspiring and current finance professionals and finance educators?

(I know it takes time, but it’s about time aspiring and current finance professionals had an effective tool for applying the Mathematics of Finance to analyze and evaluate real-world Time Value of Money situations—in the classroom, in practice, or while sitting for an industry designation examination. They’ll thank you, and we thank you for your consideration and support!)

https://www.youtube.com/@TimeValueofMoneyRules

Let the spreading or sharing begin!

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Now 312 Is More Than Chicago’s Area Code!

My wife, Sarah, and I are both teachers. Just the other day, we were talking about how nice it is to have the flexibility to choose when we want to work in the office. (Yes, teachers do work in the summer months.) The conversation was timely. Before too long, I’d be sitting down to write the week’s post which is about time.

When you’re analyzing a real-world Time Value of Money situation, here’s how it’s going to go down:

Either you’ll have the flexibility to choose which investment yield to use or not. (See TVM Rule #3.)

Regardless of whether you have such flexibility, you will need to determine whether you can use the stated yield or rate. It’s that simple. How do we know whether we’ll have the luxury of choice or flexibility? Enter the 312 “warm-up” routine.

Here’s an excerpt from my book Would Your Boomerang Return? What Birds, Hurdlers, and Boomerangs Can Teach Us About the Time Value of Money (2023):

…it takes 3 and 1 to get to 2. First you count money, next you tell time, and then you can “read and write” the true investment yield. You’ll find an entire chapter in this user manual on the topic of reading and writing “i,” which is the ultimate goal of the 312 warm-up routine.

I’ve written about the TVM Rules before. They’re important. This probably won’t be the last time I write about them. You can remember the TVM Rules with one word: indifferent. Why would you want to remember the TVM Rules? Because they were developed around the mnemonic and audible aid indifferent that helps you determine the appropriate true investment yield. Without it don’t even bother trying to work out the math.

Let’s take a look at a few words from the rearranged TVM Rules:

3. …different payment types and signs.

1. …in different points in time.

2. …correspond the time span in between periods or payments (on the timeline) and the time span of the true investment yield.

The point of the 312 warm-up routine is to determine or calculate the “i” you’ll need to apply the Mathematics of Finance as described in TVM Rule #2. But before we can do that we must cycle through the mnemonic and audible aid indifferent in a 3-1-2 manner.

First TVM Rule #3. What is the p(ay)m(en)t? In other words, a PMT or payment (PV or FV)? In further words, an even annuity or a single payment? And then you’re on to TVM Rule #1 just like that. If you’re dealing with an annuity you don’t have the flexibility to choose how you’re going to tell time. You have to use the true investment yield that matches the timing of the frequent payments.

For the real-world situations that follow, let’s say you were given a true annual investment yield of 7.7633% with monthly compounding. (Because all interest rates are expressed in annual terms right?!)

First, let’s say you’re asked to determine the future value in one year of $100 to be received today. You have the flexibility to choose which investment yield to use because you’re dealing with a lump-sum payment. If you wanted to tell time in annual terms, then you’d have your “i.” In other words, you can use the stated (true annual investment) yield. Remember, a true investment yield considers the effects of compounding! (And for the record, even if there’s no compounding during the time span of the true investment yield in the case of a true annual investment yield with annual compounding it still considers (the effects of) compounding.)

Now on to the second real-world example that considers an even annuity which contemplates monthly deposits of $100 for one year starting one month from now. In other words, the payment is frequent and level in terms of amount and timing. So, you’re using the PMT key on your financial calculator. In this example, you don’t have the flexibility to choose which investment yield to use because you’re dealing with an annuity. You’re being told how to tell time. But you still need to determine whether you can use the stated yield or rate. In this situation, only a true monthly investment yield will work. (The answer is 0.625% if you were curious.)

I’ve written about how to manipulate yields in the book and blog. That’s the point of the 312 warm-up routine, but it’s not the main point of this post which is to show you the significance and flexibility of the mnemonic and audible aid indifferent.

What true investment yield could you use for the first real-world example that considers a single payment if you were telling time with a monthly, quarterly, or semiannual time span in between periods (not payments) on the timeline? (Answers: 0.625%, 1.8867% and 3.8091%, respectively.) How many period markers would these timelines include? (Answers: 12, 4 and 2, respectively.)

Respectfully,

Brent Pritchard, Member

Boxholm Press, LLC

Brent Pritchard is an author and college finance lecturer with over two decades of industry experience and cofounder of Boxholm Press, LLC, a family-owned-and-operated publishing company providing educational content, products, and services. He pioneers an innovative and approachable new way of learning and teaching the Time Value of Money as well as thought leadership in other business topics. His most recent book is Would Your Boomerang Return? You can contact him on his website here.

Get the Book Today!

Would Your Boomerang Return? provides a fun, new take on how the Mathematics of Finance is learned and taught:

All-in-one resource: all the important information on this all-important topic in one place with chapters in the What and How sections that double as individual lessons

Ease of reference: includes the first-of-its-kind user manual for the Mathematics of Finance with chapters named after sections typically found in an actual user manual for quick look up

Simple and definitive tool: 3-Step Systematic Approach for analyzing and evaluating real-world Time Value of Money situations

Decision-making framework: 23 real-world Time Value of Money questions, space to work out answers, and a "baseball count" system to evaluate understanding of the different types of questions

An easy read: complete with sprinklings of real-life stories and maybe even an ounce of inspiration here and there

Sign up for TVM 2$days, a weekly blog that offers a fun, new take on this age-old topic and financial education insights from Brent Pritchard.